External, Internal Forces Drive Change In Water Industry

By George Mathes, Terry Brueck and Barbara Luck

What will 2002 bring? Are you in sync with customer and employee needs? Have you considered what trends will impact you the most so that you can prioritize what to address first? What do other utility managers believe to be their greatest challenges?

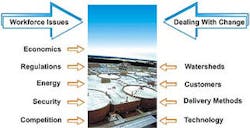

Many industry groups survey stakeholders to glean their perspectives on key business issues; EMA also conducts formal, ongoing interviews with utility managers to understand their needs. This type of information suggests that the two top industry issues are dealing with change and addressing workforce issues (Figure 1). This article takes a look at significant industry drivers and trends affecting the water/wastewater industry today and in the near future. Some are externally driven and others are more internal to the organization.

External Drivers, TrendsExternal drivers and trends are the market conditions, customer demands, and societal changes that are happening regardless of how an individual utility responds. Well-prepared and proactive utilities can stay "ahead of the curve" and leverage these industry trends rather than react.Total Watershed ManagementWatershed management is being recognized as an extremely complex subject involving federal, state, and local entities. There is growing pressure to manage all types of water effectively and with a holistic viewpoint. That includes managing the technical issues of regulation, quality, treatment and transport, and the social equity and environmental protection issues of use and access, especially in multi-jurisdictional situations. High-growth areas such as Seattle, WA, and Atlanta, GA, face the situation of being in a biologically diverse freshwater system that is additionally stressed by drought and water scarcity conditions.The industry will see increased management of agricultural discharges as point sources with the aide of technology (monitoring and sensing systems) to minimize impact on the environment and measure compliance, better land use planning, and increased water reuse or recycling as water supplies become more scarce. As former Secretary of the Interior Bruce Babbitt stated at WEFTEC 2001, "there is no more 'waste water'; think of yourself as water suppliers and watershed managers."

Figure 1. The two largest and most cited trends impacting utilities are workforce issues and dealing with change.

In addition, global climate changes may threaten historical hydrologic patterns and influence localized storm anomalies. Areas of urban growth continue to challenge agricultural water use in the West, all leading to greater demand for limited, unevenly distributed water resources.

What does this mean to individual utilities? Utilities are expected to become more involved in watershed issues and to forge closer relationships with other water stakeholders in order to exchange more information and manage water more holistically. Nontraditional sources, including desalination, reclamation, and demand-side management, will all become more important.

Regulatory Drivers, Impending RegulationsWastewater utilities should carefully watch two regulations. Early in 2001 the U.S. Environmental Protection Agency (EPA) issued a Notice of Proposed Rulemaking that would clarify and expand permit requirements under the Clean Water Act in order to reduce an estimated 40,000 annual sanitary sewer overflows (SSOs) nationwide. Pinpointed as the most neglected infrastructure in the U.S., sanitary sewer collection systems are decrepit due to poorly funded asset management practices.Currently a volunteer program within Region Four in the Southeast U.S., the proposal will require collection and treatment facilities to develop and implement new or enhanced capacity, management, operation, and maintenance (CMOM) programs. Beyond eliminating overflows, the new rule will likely require providing written summaries of CMOM programs with the public, reporting overflows that do occur, and compliance by satellite systems.

The second major pending rule is the total maximum daily load (TMDL) program. More than 20,000 river segments, lakes and estuaries in the United States are currently listed as impaired and in need of a total TMDL plan to address pollutants from multiple sources in a watershed.

A TMDL specifies the maximum amount of a pollutant that a water body can receive and still meet water quality standards. A proposed regulation expands a state's flexibility to tailor programs to their conditions, while still encouraging total watershed planning.

The EPA, which approves or disapproves lists and TMDLs established by states, territories, and authorized tribes, continues to obtain stakeholder input to recommendations by the National Academy of Sciences on a recent TMDL report and has until April 30, 2003, to revise the rule.

Water suppliers are tracking the proposed Arsenic Rule, which will lower the current arsenic standard from 50 parts per billion to 10 parts per billion, impacting many utilities with natural sources and existing treatment facilities that would not meet this new limit.

Several pending regulations are being driven by the Safe Drinking Water Act (SDWA) as amended in 1996, including the Stage 1 and 2 Disinfection Byproducts Rule, two stages of the Enhanced Surface Water Treatment Rule, and a new regulation for filter backwash recycling. The main goal is to improve physical removal of microbial contaminants. The proposed Long Term 1 Enhanced Surface Water Treatment and Filter Backwash Rule, originally planned for systems serving 10,000 or more people that use surface water or groundwater under direct influence of surface water, will apply to all sizes of systems.

Changing CustomersConcerns about the safety and quality of drinking water will continue to drive the growing market for point-of-use devices and bottled water, even at a cost which is hundreds or thousands of times the cost of tap water. A 2001 Water Quality Association survey of consumers found that 41 percent use a home water treatment device (other than bottled water) for safety and taste reasons and that 39 percent drink bottled water. With recent bio-terrorism activities, these trends will likely increase.Customers expect utilities to take the initiative in sharing information in all utility areas of responsibility, including safe water and clean environment, productivity, and utility performance. This growing, familiar trend includes a sophisticated customer profile: many times desiring information on a 24/7 basis and in electronic format. This is supported by the fact that 42 percent of the U.S. workforce now has Web access at work, up over 34 percent in 2000. Internet access is available in 67 percent of all U.S. households.

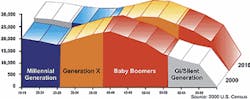

Figure 2. By 2010 the largest portion of the workforce will be moving into retirement.

The next wave beyond e-business is e-government, which includes conducting and promoting government business to consumers over an electronic network. Gartner Group estimates that by 2003, 60 percent of all levels of government will be conducting electronic transactions with constituents. Because of the tremendous savings to be gained, e-government expenditures are expected to quadruple by 2005.

This trend response requires the right combination of technology, process improvements, communication, information, and customer service. ICSA's June 2001 e-satisfy study supports this indication with responses including that business customers expect a complete response to e-contacts within four hours.

Energy Costs, ReliabilityThe days of "penny-cheap" energy are truly history and, as a result, consumers and utilities must now adjust to a newly deregulated and re-regulated environment.Over the past 10 years, as electric companies have broken into generation, transmission, and distribution companies with subsequent mergers and consolidations, dollars spent on transmission lines and generating plant construction have decreased while demand has climbed. This has led to localized and regional shortages, the most significant being California's rolling blackouts.

With the resulting unintended consequences brought about by deregulation, fluctuations in price have been so significant over the period of just a few days that the peak demand price of electricity can bounce back and forth between $50 and nearly $3,000 per kWh. Some California private water utilities are experiencing up to 50 percent increases in their annual electric costs with a wide variety of pricing schemes.

These factors are threatening the near-100 percent reliability of electricity known in the past. As Vice President Dick Cheney's Report to the President on Energy Needs points out, U.S. energy requirements call for up to 1900 new power plants to be built during the next 20 years. The best way to meet the nation's energy goals is "to increase energy efficiency by applying new technology, raising productivity, and reducing waste and trimming costs."

The current uncertainty in electric supply reliability and capacity is both a threat and an opportunity to the operation of water and wastewater utilities. The ability to shift major energy loads and peak demands, combined with electric on-site micro-generation (especially bio-gas "green power"), can allow water/wastewater utilities both increased electric reliability and cost advantages.

The need for distributed generating capacity makes water/ wastewater utilities and electric utilities ideal partnering candidates for advantageous rate structures in both buying and selling energy.

Economic IssuesThe average price for water in the world increased in 2001 by 3.8 percent over the past year. The NUS Consulting Group, which conducted the survey, also describes the global water market as being driven by issues of scarcity and demands for improved water quality. These two factors guarantee much larger rate increases in the near future.On a grand infrastructure scale, the water and wastewater industry faces a $1.7 trillion price tag for total system investment (capital, operations, maintenance) between 2000 and 2020. According to the U.S. EPA, this figure includes repairs and new construction needed to meet new regulation requirements and growth. Most at risk are water transmission and distribution lines while the most costly for wastewater utilities is addressing CSOs and SSOs.

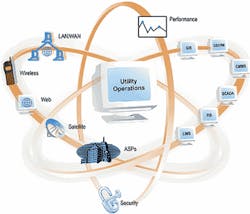

Figure 3. Utilities should leverage advanced technologies to support their business needs.

The infrastructure of the industry is not without its regulatory challenges. The new GASB 34 regulation requires utilities and public works departments to report their capital assets including infrastructure, with historic value depreciation or proof of maintaining proper condition through a comprehensive asset management system. Depending on revenue generated, deadlines for compliance are June 15, 2002, or June 15, 2003.

Of course, asset management and maintenance play a major role in lengthening the service life and condition of the infrastructure. Traditionally, asset management has not been applied well by utilities because resources have been used reactively without appropriate technology and practices to support it. However, utilities are now driven to apply asset management strategies due to reduced O&M funding, pressure to maintain or lower rates, and foreseeing the end of the useful lifespan of many assets.

Workforce DemographicsOver half of a typical utility's workforce is at least 40 years of age (Figure 2). In addition, as this "boomer" age group retires in the coming decade, their replacement and succession with new workers is compounded by the smaller percentage of population (today's 25-40 year "Generation X") and diminishing numbers of technical and engineering skills available. Especially difficult to hire will be management and technical staff, where utilities will need to bid for talent with competing and often more lucrative industries and well-branded businesses.Employees will reflect the diversity of the community. Job loyalty will also diminish with the new workforce typical in their three-to-five year job longevity. The marketplace will continue to force increasingly flexible work schedules and conditions, including family benefits and "telecommuting."

Restructuring and CompetitionPublic utilities have responded to the pressure of contract operators by optimizing their own operations and applying strategies of automation, benchmarking, performance measurement, and training. Considering growing interest in programs such as the joint AWWA/WEF QualServe program and Benchmarking Clearinghouse, several WERF/AWWARF Performance Management research projects, and AMWA/AMSA programs on competitiveness and business performance, public utilities understand the need for a formal process for measuring improvements.Based on EMA's operational assessments, the utility competitiveness gap (lost productivity) has dropped from 26 percent in the mid-90s to about 22 percent in 2001. Regardless of whether it's referred to as continuous improvement, optimization, or performance management, a growing number of utilities are embarking on programs to increase effectiveness, improve quality, and reduce costs.

Growth of state laws requiring Qualifications Based Selection (QBS), that is procuring professional services on a qualitative basis and not low price, shows that quality service and long-term value is being embraced more now than in the past.

The steady pace of foreign acquisitions of U.S. water utilities seems to be driven by the fact the U.S. is the last largely public owned and operated utility market that holds privatization potential and therefore, growth through marketshare. The switch from public utility operation to private contract operators has slowed from previous year's pace, but is still increasing. For a number of small public utilities, cooperative inter-utility agreements are growing where larger regional utilities become the service provider or facility maintainer and/or operator, especially in adjacent geography.

Security IssuesMany utilities have traditionally prepared emergency response plans to react to incidences of natural disaster, sabotage or terrorism, but have not done nearly enough to prevent these attacks from happening in the first place. Since the tragedy of Sept. 11, there is heightened demand and attention to actively protect water resources and infrastructure, taking steps to minimize terrorist opportunities and avoid disruption of service and damage to systems through prevention or early detection in real time.The Environment and Public Works Committee has asked Congress for $5 billion to upgrade U.S. water system security as water and wastewater entities scramble to assess vulnerabilities. Utilities have already taken steps to protect their assets including posting guards, installing tamperproof manhole covers, and investigating further use of technology. For example, by integrating video, audio, and data from a SCADA system with automatic monitoring, utility staff know immediately about potentially devastating activity and can respond to the issue before it becomes a problem.

Internal Drivers and TrendsInternal utility forces and opportunities are the drivers that utilities can often control more directly than external industry forces. Many of these trends reflect choices to be made by utilities either today or near term.Workforce DevelopmentThe "not my job" mentality is slowly evaporating in public work environments, as utilities face competition and adopt private sector models of workforce flexibility. Training and development of employees are key in the transformation to new multi-skilled workers, with skill-based compensation providing incentives for change. Utility management and leadership development are growing through initiatives such as the jointly sponsored AWWA/WEF/AMSA/ AMWA Leadership Center for Water and Wastewater Utilities.New compensation models are slowly emerging, including moving from traditional cost-of-living increases to gain sharing and pay-for-performance. Coupled with programs for utility improvements and performance measurement, these reward mechanisms are evolving more quickly in organizations that have the latitude to implement without needing to change an entire municipal structure.

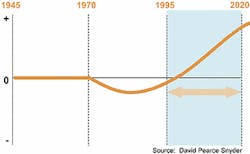

Technology EvolutionAs shown in Figure 3, computer technology is just today in the early stages of its third 25-year phase of maturation from "non-productive" (1945-1970), to "counter-productive" (1970-1995), to today's "hyper-productive" phase (1995-2020). As we see this maturity take shape, the application expands in both the business arena with customers and the "product" arena with water/wastewater delivery, collection, and treatment.Figure 4. An integration utility view shows that infrastructure, data, and applications together provide utility-wide information.

Continued integration and automation using web enabled SCADA, GIS, CMMS, LIMS, and CIS provide efficiency, speed and cost-effective utility operations (Figure 4). Further application of instrumentation and smart devices (equipment with embedded chips) enables more unattended facilities while still providing better information for control and management.

Underlying technology and communication provides even greater access to employees and equipment regardless of location. Field workers' immediate access to water system on-line measurements, records, and customer history while in the office, field, or at their home improves response times. Tremendous growth of wireless communication is expected. Nationwide with speeds of up to 10 megabaud, wireless communication can make new modes of collaboration practical and will reshape notions of workplace/time and worker roles.

Alternative Delivery MethodsA recent Zweig White survey shows that use of design-build is up, with about 50 percent of water/wastewater utilities having used the alternative construction method. Design-build-operate (DBO) revenue for contract operators has also been increasing in recent years, with an 18 percent increase in DBO fees from 1999-2000.According to Public Works Financing, less than five percent of the municipal utility market is currently held by private contract operators. Consolidation, mergers, and acquisitions continue at a fair pace, resulting in fewer, larger global players. Recent acquisitions of large firms include the cascading tail of American Water Works. While American had recently acquired Citizens Utilities and Continental Water and was in the process of buying the contract operations of North America Azurix, they agreed to be acquired themselves by a new player, RWE.

The German company RWE has newly acquired UK-based Thames Water slated for a management role. RWE demonstrated how quickly a new player can enter the U.S. water utility market and become the third largest water company in the world.

Customer RelationsMore education and learning for customers and stakeholders continues to be a largely unaddressed need. According to a 2000 survey conducted by The National Environmental Education & Training Foundation (NEETF), two out of three American adults still fail a simple environmental quiz. Further, the proportion of respondents who say they try to conserve water or reduce the garbage they produce is lower than in the past two years.Obtaining client feedback is an essential part of customer relations. Best-practice organizations need to develop formalized, ongoing processes to understand what their customers value and consider ways to deliver those items. Data privacy becomes a major issue as customers demand balance between available information and sharing their personal information.

ConclusionThe impact and extent of these trends on utilities can be overwhelming, especially as the pace of change demands greater urgency and action. Whether or not change management and workforce issues are your top two issues, these and other trends will undoubtedly shape your tomorrow and how you respond. Stay up-to-date with today's industry trends and identify those that will have the most impact on your operation. If you are well informed, you can plan and take actions to be ready for what 2002 and the changing industry brings. WW/Note: EMA, Inc. is an ideas-through-implementation management and technology consultant in St. Paul, MN. Web: www.utilityfocus.com or www.ema-inc.com.