Water and Wastewater Construction: Continued Gloom or Future Boom?

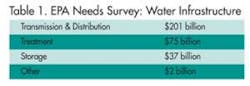

The state of water and wastewater infrastructure in the United States is a much discussed and lamented topic these days. With funding needs estimated in the ballpark of $600 billion over the next 20 years, coupled with the economic downturn and reduced federal funding, the task of repairing our aging infrastructure seems daunting if not insurmountable.

The current condition of the water and wastewater construction market in North America is reflective of that sentiment. In general, the construction market has been hard hit by declining public sector demand, losing 20,000 jobs between September and October, according to recent data from the Associated General Contractors of America (AGC). Further, the construction industry's unemployment rate hit 13.7% in October, well above the national average of 9% reported by the Bureau of Labor Statistics.

With respect to water and wastewater construction specifically, potential budget cuts to the State Revolving Loan Funds paint a gloomy picture. While not yet finalized, the Senate Appropriations Committee draft bill provides $1.52 billion for the Clean Water State Revolving Loan Funds and $963 million for the Drinking Water State Revolving Loan Funds, in total about $1 billion less than in FY2010.

Scott Berry, director of AGC's Municipal & Utilities Construction Division, said, "We're probably looking at another large decrease in the federal water infrastructure budget. And while that's not the entirety of the water construction budget, we're seeing a decrease in municipal bond issuance as well."

Most of the budget for water infrastructure happens at the local level, he explained. This has declined, he said, particularly since the close of the Build America bonds, which infused an investment of some $38 billion in the water and wastewater market.

"When the downturn first hit, we began to see various municipalities looking to reduce spending even on existing projects that were either placed on hold during that time or were ready to break ground," said Eric Meliton, a research analyst with Frost & Sullivan's Environmental & Building Technologies division. "That was mainly due to the lack of budgets," he said.

Weaknesses in the bond market as well as fear that the recession would persist also contributed.

"That being said, there were still municipalities that went forward with a lot of their projects," Meliton pointed out.

The major reason: ARRA.

The American Recovery and Reinvestment Act of 2009 injected about $6 billion dollars into water infrastructure in the United States via the SRF program — about $4 billion for the CWSRF and $2 billion for DWSRF.

"The stimulus funding invested a lot of money in the short term for existing projects that were ready to start," said Meliton. "But now, that funding is essentially gone."

That, combined with reductions in SRF funding for wastewater and drinking water projects, he said, indicate that municipal investment in construction projects will likely continue to slow down.

Tom Decker, a vice president at engineering consulting firm Brown and Caldwell, has a slightly more encouraging perspective.

"Water and wastewater is doing better than many markets," he said. "Particularly if you look at last year when a lot of markets were down noticeably year over year in high double digits, the water and wastewater market was actually positive for most of last year."

Water and wastewater construction didn't begin experiencing a tail off until the spring of this year, he observed. That's primarily because of the boost from the American Recovery and Reinvestment Act.

"If you compare just about any month in 2010 versus 2009, you'll see it's up nicely." He did point out that, indeed, since about March of this year, a comparison of 2011 to 2010 indicates a bit of a decline. "But really what you're seeing is the effect of the fairly rapid spending of the stimulus money," he explained.

As far as where the market is headed, Decker is confident that it's closer to flattening out than experiencing a longer period of decline.

"I think we're at a juncture here," he said.

Looking across the country and comparing notes with other engineering firms, Decker said more design projects are being booked now than a year and a half to two years ago.

"What's being designed now is going to be built in 6 to 12 months," he explained. "So I think there are signs of plateauing at the bottom."

He conceded that there may be a brief period of slightly more decline, but over the course of 12 to 18 months, he is optimistic that the market will begin to climb once again.

As already inadequate federal funding begins to shrink further, one thing that could help spur growth, Berry said, is investment of private capital into the water and wastewater market.

"Private investment in water infrastructure is one of the ways I think you're going to see a little bit more interest [in the market]," he said.

The AGC and other organizations are working hard to create better vehicles for investment into public water infrastructure. There are many different strategies being debated: a Clean Water Trust Fund, public-private partnerships, a federal infrastructure bank. But perhaps the industry's best hope for much-needed financial support is through private activity bonds.

As Peter Krainock, CEO of American Water Works International, explained in a recent WaterWorld article, private activity bonds (PABs) are a tax exempt funding mechanism that allows a private entity to partner with a municipality or state to meet a public need. The interest paid on bonds issued by states and local governments is excluded from gross income for federal income tax purposes, which often makes investors willing to accept a lower rate of interest than they might accept on a taxable investment. The lower interest rate reduces the borrowing cost for the government entity.

Today, there is a limit on the total volume of tax-exempt bonds a state can issue annually. Because of that cap, most PABs are used to finance smaller, shorter-term projects. In fact, in 2007, only 1.3% of all private activity bonds were issued to water and wastewater projects.

There is legislation working its way through Congress that seeks to eliminate that cap for water and wastewater projects. The Sustainable Water Infrastructure Investment Act of 2011, introduced last spring, has garnered the support of some 50 cosponsors and currently sits with the Committee on Ways and Means. If water and wastewater projects could be exempted from the volume cap as some municipal ventures, such as airport, rail and solid waste disposal projects have been it could mean billions of dollars in private capital flooding into the market.

"We're talking roughly two to five billion dollars a year in additional private investment in water infrastructure if the cap is removed," said Berry.

Given EPA's estimate of a $500 billion gap in funding for water and wastewater infrastructure over the next 20 years, that type of investment could potentially deliver some much needed relief.

There's no question the water and wastewater market has seen some ups and downs over the past two years. Although the market may not be completely out of the woods just yet, Decker is confident that it will rebound.

"We're going through a little difficult patch here," he said. "The water and wastewater market is a good solid market to be in. It always has been, it always will be."

It may not ever spike like dotcoms or housing, he noted, but it's also not going to tumble and fall that far. "It's got a steadiness to it and a reliability to it that's going to keep it up."

About the Author: Angela Godwin is Digital Media Editor for the Water Group at PennWell, which includes WaterWorld. She may be contacted via e-mail at [email protected]

More WaterWorld Current Issue Articles

More WaterWorld Archives Issue Articles