The public-private concession agreement is being hailed as a model program for municipalities in California and elsewhere faced with financial challenges, water and wastewater infrastructure problems, and erosion in public confidence.

Fox was referring to a 30-year public-private concession agreement in Rialto that secured approximately $35 million in cash for economic development, $41 million in funding for water and wastewater system improvements and associated jobs, and gained the expertise of a professional water company to deliver system and service improvements. While commonly utilized in Europe and Asia to build and operate essential infrastructure, this concession-type agreement is less common in the United States.

The agreement is being hailed as a model program for municipalities in California and elsewhere faced with financial challenges, water and wastewater infrastructure problems, and erosion in public confidence.

"Our community needs jobs. This plan creates jobs, directly and indirectly," said Mike Story, city administrator for Rialto. "It also creates opportunities for broader economic development, and allows us to address basic structural and operational needs that residents expect us to fix."

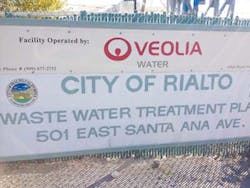

The public-private concession agreement teams Ullico Inc., Table Rock Capital and Veolia Water West Operating Services with the city, leveraging private capital and expertise with a strong local knowledge base and a detailed timeline to fix and replace water and sewer lines, develop necessary new infrastructure and improve cost efficiencies.

Washington, DC-based Ullico, through its infrastructure business, is the majority equity investor in the newly formed Rialto Water Services (RWS). San Francisco-based Table Rock is co-owner of RWS. Veolia, which had operated Rialto's wastewater system for the past decade, now operates both water and wastewater.

The $41 million will be used to finance a capital improvement program, improving the cost efficiency, compliance, water quality and reliability of the water and wastewater systems. The capital program will create 445 construction jobs. All affected city employees have accepted jobs at Veolia.

"We've worked with Rialto for almost 10 years and have established a relationship of trust that supports the community's economic vitality," said Laurent Auguste, president and CEO of Veolia Water Americas. "Rialto is taking the right step in restoring and improving its infrastructure, and we're excited for the opportunity to help them through our new role."

Fox, who now works for Veolia as project manager, said he sees positive changes already. As an example, because water and wastewater employees all work under the same umbrella, expertise can be shared and problems - wherever they occur - can be addressed in a timely manner.

"The nice thing is, through this concession agreement, there is a commitment to address problems that need to be fixed, and we have the oversight and streamlining to make it happen," Fox said. "We're also not starting with new people. We have the institutional knowledge and we're all on the same page. It all relates to public health. We can't have any delays whatsoever."

Edward M. Smith, president and CEO of Ullico, the only labor-owned insurance and investment company in the world, said the 445 jobs created as a result of the capital improvement plan will go to members of the local building and construction trades.

"We believe that investing in infrastructure requires applying best practices like having long-term public and private partners, building strong, community-driven solutions and having local partners, including local unions and local union contractors," Smith said. "Our program focuses on investing in projects where the municipal partners and our investment partners share this philosophy."

What also distinguishes the Rialto plan is that the city retains full ownership of the water and wastewater systems, water rights and public authority for rate setting. On a practical level, it allows the city and community to retain an invaluable asset while also serving as a true, long-term partner with a significant voice in managing expectations.

"At the end of the day, regardless of whose name is on the sign, people are going to come to us if they're not happy," said Story. "We need to retain ownership and be an active partner."

Sonia M. Axter, managing director of infrastructure investment at Ullico, takes a similarly holistic view. "It is important that infrastructure assets - designed to last 50 or even 100 years - be viewed as long-term businesses essential to a community, and not simply as construction projects," she said. "These assets are important to the provision of basic services, such as clean water and electricity, and critical to the long-term economic health of a community."

To that end, the concession agreement provides lease payments back to the city supporting additional economic development and jobs locally. Projects that had been threatened as a result of the loss of redevelopment funds - a Wal-Mart supercenter and a multimillion-dollar mixed-use development at the current Rialto Airport site, for example - are now moving along.

"With the loss of redevelopment financing, creative partnerships such as these are increasingly critical to communities that want to restore infrastructure, gain efficiencies and get a competitive edge when it comes to creating jobs and economic growth," said Peter Luchetti, principal at Table Rock Capital.

For Fox, a Rialto resident for life, it's a great message and even better reality.

"This is my community, and to be part of something that will keep it moving forward for years to come is truly something special."

About the Author: Steve Lambert joined Southern California-based communications firm The 20/20 Network in 2011 after 34 years as a national award-winning reporter, editor and publisher at newspapers across the country. For the past decade, he ran newsrooms and newspapers throughout Southern California - as editor of The San Bernardino Sun and Inland Valley Daily Bulletin, as publisher of the San Gabriel Valley Newspaper Group, and as vice president-news for the parent Los Angeles Newspaper Group. In that time, he earned national acclaim for his innovative approach to digital storytelling, his civic leadership and a business acumen.

More WaterWorld Issue Articles

WaterWorld Articles Archives