More and more utilities are integrating advanced ICT solutions into their operations. And with smart water metering helping to identify and reduce leakages and non-revenue water, the European market could be worth up to $13.4 billion by 2020. Seth Cutler reports.

The water and wastewater industries, like many others, are currently undergoing a process of transformation through the use of ICT and near real time data generation. The aim is to increase operational and management efficiencies, to reduce expenditures and carbon footprints through smart water metering.

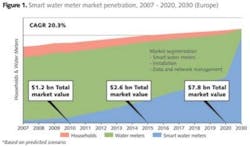

This market is undergoing rapid development. In Europe alone, smart water metering is expected to generate a cumulative investment of $7.8 billion by 2020. Should the investment environment improve, bolstered in part by strong government support, this market should grow further to $13.4 billion over the same period. While initial investments are heavily in smart water meters and installation fees, data and network management quickly grows to provide a majority of yearly revenues for the market.

The strength in this market is found in its ability to offer water utilities specific paths towards operating cost and carbon footprint reduction, while improving service and supply management. These include identifying end point leakage, gaining clarity between leakage, non revenue water (NRW) and chargeable consumption, establishing consumption patterns and using predictive analytics to regulate supply and setting up adjustable alarm notifications to predict/prevent end point anomalies.

On a wider scale, smart water metering at utility endpoints can help infer leakage and events at a localised, neighbourhood level. Regional and global backdrops of economic uncertainty and increasing environmental pressures only serve to enhance the attractiveness of smart water metering. Furthermore, there has been a mandated rollout of water meters in Ireland, a condition of the European Union and International Monetary Fund bailout. This adds weight to water metering as a driver for equitable long-term revenue generation. Smart water metering is an extension of this, providing greater accuracy, justification and enhanced management of water utilities.

Smart water: a brief history

The smart water metering market emerged in the 2000s as water utilities responded to global trends of using detailed and near real time data and analytics to deliver more predictive and proactive services. The backbone of this effort is advanced metering infrastructure (AMI) technology. AMI can provide a remote and constant two-way data link between utilities, meters and consumers. Communications are delivered through various technologies including power line communications (PLC), telephony, broadband, fibre optic cable, wireless radio frequency and cellular transmissions.

Through a communications infrastructure of concentrators, repeaters and gateways, data is passed between meter and utility and funnelled into analytical software that can immediately set off pre-determined alerts. This is as well as produce accurate billings and consumption patterns at neighbourhood and area levels, inform other utility software such as GIS (Geographic Information Systems) and SCADA (Supervisory Control and Data Acquisition) and departments including customer services, pumping stations and reservoirs. Apart from monitoring the current status of water consumption, data can contribute towards hydraulic modelling to help predict outcomes and changes in water distribution.

Hydraulic modelling and network monitoring can be used by utilities to make evidence-based network investments and upgrades. Utilities can also send information back to the meter to perform remote upgrades and fixes, reset alert parameters, shut off water supply during change of tenancy or reduce water flow for unpaid accounts.

AMI vs. AMR

Smart water metering, however, does not come without a set of questions, uncertainties or debates. Four of the largest industry debates centre on technology, operations, communications and the marketplace.

Water utilities often debate whether to fully convert to AMI or run an AMR (automatic meter reading) water grid instead. The truest of smart water grid definitions requires AMI technology and its enabling two-way communications. Many water utilities, however, do not see a clear advantage to AMI and feel the "smart-lite", uni-directional communications from meter to utility offered by AMR is fit for purpose.

Receiving one-way information for accurate billing, leakage and NRW detection and GIS and SCADA is viewed as solving the bulk of water utility needs. Many water utilities feel the financial cost to roll out and operate an AMI grid will not justify the benefits of two-way communications. It is felt that remote upgrades rather than replacements will be infrequent, centralised alarms will be sufficient and utilities will rarely restrict water flows into homes, even if this is legally permitted.

This issue needs to be addressed on a case by case basis, but water utilities, widely known to be risk-averse, will find the most "future-proofed" investment in AMI deployments. An example of which is the UK's most advanced project currently being deployed by Thames Water in London. AMI offers the most advanced capabilities and as this technology evolves and utilities grow more sophisticated in their data analysis and operations, AMR deployments may prove limiting; water utilities stand to gain the most through AMI.

Smart water metering differs from smart energy metering in that smart water meters are rarely in convenient reach of mains power supply. As a result smart water meters are dependent on a reliable and long-lasting battery to power data transmission. Ensuring a 15 year battery life, which matches the lifespan of most meters, is essential for investments. Because of the proximity to water and possible submersion of meters, batteries are sealed water-tight and are not meant to be replaced.

Operating an AMR deployment with scheduled data transmissions does not impinge on this 15 year battery life. Deploying an AMI system, however, where meters must be constantly ready to receive incoming transmissions can drain battery life significantly, down to eight years or less. This has a large impact on the business case for investment. The market is seeing solutions to this challenge where meters will power up to potentially receive transmissions on scheduled intervals (one minute, five minutes etc) rather than a constant state of readiness. This ensures maximised battery life and offers the benefits of a two-way AMR-like communications system.

Forward planning

Water utilities in Europe, and indeed globally, are not traditionally the fastest adopters of ICT solutions. Many industry leaders and employees are engineers by training and the IT transformations in the business world over the past few decades are not, at face value, the most natural solutions to incorporate.

In deploying a smart water metering communications network, water utilities must make decisions on what technologies to use in data transmissions: telephone wires, power cables, broadband, fibre optic cable, radio frequency, cellular or emerging options such as WiMax. These various options differ in popularity, cost, reliability, security and scalability among, other indicators. Getting to grips with the different network options presents a barrier to water utilities as they seek the most appropriate option for their circumstance.

While there are no broad standards for water utilities to base these decisions on, many of the deployments seen use either radio frequency or cellular communications. Utilities are also not constrained by one technology; numerous deployments, such as Glendale Power & Water (USA), have used complementary communications technologies to build a robust network. Until widespread best practice and standards evolve, water utilities will need to be careful in their decisions to ensure their communications network is long-lasting. The amount of forward planning can be seen as an obstacle in adoption for many water utilities.

Investment guarantee

Water utilities also require assurance that they are not about to invest in technology and software that will come to an abrupt end. Data and network management services are offered by a plethora of businesses from bespoke smart water metering companies, to medium size firms tailored towards utility needs and global ICT giants (who may be looking to acquire smaller competitors for their niche expertise).

The resulting market environment has yet to witness clear leaders and, like network communications options, demands utilities invest much time to study their options to ensure intelligent investments. However, in the coming years, it is expected that leaders will emerge, the playing field will become consolidated and standards will be developed that simplify decision-making processes.

The bottom line for water utilities investigating smart water metering, however, is the business case. These issues of technology, communications, operations and marketplace partners impact the cost of deployment, speed of return on investment and how the water utility will physically transform itself into a smart(er) utility. Despite these challenges, the immediate and long-term impacts of smart water metering and smart water grids represent significant savings. Water utilities can save up to 20% of water leakage levels and reduce energy consumption by 30% through smart water infrastructure.

WaterUK has revealed that 2-3% of the total energy consumption in the UK is accounted for by the water industry. As energy costs can eat as much as 65% or more of awater utility's annual expenditure and much of this due to pumping and transporting water, reducing this figure by 30% will have a dramatic reduction in operational expenditures for water utilities. The cost of not reducing energy bills in conjunction with expected rises in energy costs could be dramatic.

For example, the Water Supply Association of Australia reports that each $1 increase per megawatt-hour of electricity will result in a $1 million rise in costs for treating and transporting water. While water utilities may not see the immediate need to plan and invest in smart water metering and smart water grids, it is ill advised to ignore the medium and long-term situation. Smart water metering represents a solution that will contribute to the reduction of water consumption, leakage and waste and energy use.

Market opportunities

This leads to a predicted cumulative market opportunity in smart water metering of $7.8 billion by 2020 for meter manufacturers, installers and data and network management companies. Of these three segments, however, the largest to represent long-term, sustainable value is data and network management (figure 3). Once smart water metering is established, further revenue for meter manufacturers and installers will come from timely replacement and upgrading of meters.

Data and network management, however, has a real opportunity to grow in depth and sophistication for water utilities. Solutions for billing, customer service, asset management and modelling will become more advanced and offer a greater depth and accuracy in analytical ability. It is also expected that services will grow in scope, to work with and manage other water utility IT needs – some of which are likely to be uncovered as the industry grows in its understanding of how IT solutions can help water utilities.

The necessity for water utilities to adopt smart water metering is clear and the resulting market opportunity for meter manufacturers, installation companies and data and network management business has been carved out. This is a growing market not without questions and debates that will gradually be worked out, but in the current climate of carbon footprint reduction, economic uncertainty, environmental stress, water scarcity and the growing awareness of the costly relationship between water and energy use, smart water metering stands out as a contributing solution to each point.

In addressing the breadth of this market, various strands of business that may have had little to do with each other a decade ago now find themselves increasingly in partnership. This presents a large and growing source of industry convergence. Water utilities, smart water meter manufacturers, installation companies, communications network and telemetry providers, meter data and network management firms, cyber security businesses and others are building partnerships and merging to provide smart water metering solutions rather than leaving water utilities to manage a host of different contributors to its smart meter grid. Much growth will be secured through proactive companies that position themselves centrally in this industry convergence as smart water metering specialists. WWi

Author's note: Seth Cutler is a research analyst at industry analysts Frost & Sullivan. The article is based on a report on expanding smart water metering and smart water grids. For more information please email Fredrick Royan, research director for global environment (water) markets: [email protected].

More Water & WasteWater International Current Issue Articles

More Water & WasteWater International Archives Issue Articles