With the Water Ten guidelines now set, how will they impact China’s investment into wastewater in the 13th Five Year Plan?

By Tin Siao Soh

The fact that China’s rapid social and economic development is resulting in the degradation of the ecological environment is not news anymore. Water pollution is just one of the environmental challenges facing China’s policy makers. Just how serious is the problem? According to statistics from the National Development and Reform Commission (NDRC), around 32.5 percent of China’s seven major river systems and 29.2 percent of China’s major basins do not meet the prevailing water quality standards (grade III and below) in 2015.

This has been largely due to the long history of unfettered emission of untreated/under-treated industrial, agriculture as well as domestic wastewater into these water bodies. Not only this, investments in wastewater treatment facilities have been both lacking and lagging behind. In the 12th Five Year Plan (FYP) period, investments into treating wastewater have decreased, even as investments into cleaning up industrial air emission have increased substantially. In a bid to reverse this, the Chinese government amended the new environmental protection law and imposed a set of “Water Ten” guidelines in 2015. In this article, we will explore the 13th Five Year Plan on Urban Sewage Treatment and Water Recycling Facilities Planning (FYP) and the impacts and new opportunities it might bring.

PART I - Sector Overview

China’s wastewater treatment industry broadly covers the treatment of influent, sewage treatment and water recycling (mainly non-potable, for irrigation or industrial water reuse).

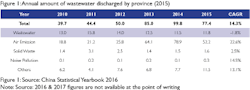

In 2015, around 74 billion tons of wastewater was discharged by China’s population, industrial users and other commercial users. Of this, around 67 percent came from the municipal (mainly household) sector, 25 percent came from industrial sectors and 8 percent came from other centralized pollution control facilities. More wastewater is discharged by provinces along China’s coastal and Yangtze River economic belt provinces than the inland ones. Despite being a coastal province, Tianjin’s wastewater discharge volume is notably lower. This is because many of China’s first large scale municipal wastewater treatment projects were built there.

After used water is being discharged by households or industries, Chinese law requires that the wastewater be collected and treated before being released into the waterways. But in reality, few factories do so conscientiously because of the high cost involved. In earlier years, there were even reports of local governments halting the operations of their wastewater plants to save costs.

Municipal wastewater treatment is typically undertaken by local governments, especially in the urban areas. Industrial wastewater treatment, on the other hand, is often done in-factory or in centralized treatment facilities located within industrial parks. Other commercial entities like tourist attractions or holiday resorts, nursing homes, airports or railway stations may sometimes have their own wastewater treatment facilities, in which case, they have been classified in the third broad category. Because the demand in this sector is relatively fragmented, official statistics on the installed base for this sector are not available.

Installed Base – Municipal Wastewater Treatment Market

According to the NDRC, China’s urban municipal wastewater collection network by end 2015 comprises of around 540,000 km of drainage pipelines, with sewage, rainwater and other combined sewage pipes accounting for 42 percent, 38 percent and 20 percent respectively. There are around 1,944 municipal wastewater treatment plants across China’s city/urban regions and 1,599 municipal wastewater treatment plants across China’s counties, accounting for daily processing capacities of 140 and 29 million cubic meters respectively. Higher concentrations of these are located along China’s coastal provinces like Guangdong, Shandong and Jiangsu, as well as in provinces that are located along the Yangtze River.

In 2015, only 11.4 percent of China’s villages had access to wastewater treatment facilities. Beyond the villages, only about 7 percent to 25 percent of China’s towns and townships had these facilities. The penetration rates of wastewater treatment facilities in China’s rural or suburban areas were still relatively low.

Installed Base – Industrial Wastewater Treatment Market

At the end of 2015, the installed base of industrial wastewater treatment facilities in China is around 83,227, with a daily treatment capacity of 247 million tons. But in practice, despite having an annual treatment capacity of around 90 billion tons, the actual amount of wastewater treated in 2015 is only about 44 billion tons - which means a utilization rate of barely 50 percent. The metallurgy, chemical and paper manufacturing industrial sectors are three of the top spenders on wastewater treatment in China. On average, the expenditure for treating 1 ton of wastewater in the industrial sector is about RMB 1.50.

PART II - 13th Five Year Plan for Wastewater Treatment

In the 13th FYP, China aims to spend around RMB 559 billion or 0.75 percent of its GDP on its water treatment industry. This national level spending will account for only about 10-30 percent of the total financing supply in this sector. Apart from the national level funds, China’s water treatment industry gets its funding from the provincial/local government funding, domestic banks and the private sector. Over the past decade, fiscal spending into the wastewater treatment industry has been primarily directed into municipal wastewater treatment projects or centralized wastewater treatment facilities located within industrial parks. Industrial/commercial in-factory or onsite wastewater treatment facilities are typically built using private funding.

On the whole, with the growing shift towards environmental protection, demand for wastewater treatment facilities has increased across all sectors. The demand amongst industrial users has also been strong due to the more stringent environmental regulations and enforcement. Errant polluters have been shut down and smaller sized factories who could not afford the expensive wastewater treatment equipment might increasingly be forced into industrial parks with centralized pollution control facilities.

Project Breakdown

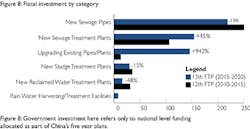

From the fiscal spending allocation in figure 8, we can see that most of the government funding will be going into new sewage piping projects, new sewage treatment plants as well as upgrading of existing wastewater treatment infrastructure. Compared to the previous FYP, upgrading works will receive the largest increase in terms of funding while investments into reclaimed water treatment plants will experience the largest drop. RMB142 billion or 25 percent of the total spending will be allocated to upgrading works on existing sewage pipelines and sewage treatment plants.

Of the amount allocated for upgrading works, around 70 percent of the funds to upgrading works will be directed to the country’s sewage piping infrastructure, distributed roughly equally between sewage pipes and combined sewage pipes.

On the whole, the total funding for the wastewater treatment industry is set to increase 31 percent in the 13th FYP, from RMB 427 Bn to RMB 559 Bn. While most provinces will receive a net increase in funding amounts, some provinces like Tianjin, Beijing, Inner Mongolia will see less central funding in the 13th FYP.

Guangdong and Zhejiang are the top two provinces that will receive the most amount of national level funding for their wastewater treatment industries. Zhejiang, in particular, will have around 87 percent more funding compared to the previous FYP. Apart from Zhejiang, Liaoning, Chongqing and Qinghai will also receive significantly higher funding amounts compared to the previous period.

Even though new sewage piping projects are a common feature for most provinces in the 13th FYP, demand for wastewater treatment facilities will still look slightly different for some provinces. For instance, close to 50 percent of funding for Shanghai will be allocated for upgrading works while Beijing’s focus is more on new sewage pipelines and treatment plants, where only about 10 percent of the funding in Beijing is for upgrading works.

PART III – Industry Outlook

Opportunities in the Industrial Wastewater Treatment Sector

With growing demand and availability of funds, this sector is expected to grow significantly in the near future. More stringent environmental mandates will drive demand from the industrial sectors pushing for new investments or upgrades of in-factory and centralized wastewater treatment facilities. Moreover, a slowly recovering manufacturing sector will also drive demand, as resumed production in various manufacturing industries stimulates the need for water and water recycling, particularly the textile, chemical and petrochemical industries. Given the growing need for water conservation and tightening environmental regulations, demand for wastewater treatment facilities will grow.

Opportunities in Municipal water

Because the bulk of China’s wastewater is generated by the household sector, demand from the municipal wastewater treatment sector constitutes a significant portion of the market. As local governments expand their municipal wastewater treatment coverage from urban areas to the counties and towns, where the penetration rates of wastewater treatment facilities are still low, demand here will be strong. Even in the urban areas, local governments are also faced with higher targets in working towards a more efficient use of their wastewater through water recycling. And for provinces that already have higher wastewater treatment coverage, much investment is still needed to repair outdated and old piping and treatment systems. Replacement of old wastewater treatment infrastructure in regions such as Guangdong, Liaoning, Shandong and Shanghai will also catalyze the market growth.

In general, China’s municipal wastewater treatment systems are decentralized and come under the jurisdiction of local governments. Any investments into local wastewater treatment facilities are taken up by the different tiers of government, according to local needs. There is no centralized management of wastewater treatment facilities in China. This means that potential investors looking to enter the municipal wastewater market or those looking to expand beyond a particular province might be subjected to different regulatory procedures and standards.

Opportunities for Suppliers

While it is true in most cases that Chinese suppliers are more price competitive and many local governments favor local suppliers over overseas companies, foreign water treatment filtration and disinfection equipment, process technologies are still highly valued by downstream customers, given its high quality and reliability. This will benefit not just wastewater treatment equipment and systems suppliers but also those in complementary sectors like wastewater chemicals, piping materials, sewage pumps, non-corrosive coatings for pipes etc. Many international companies like Veolia and Gradiant have already been very active in developing projects and cultivating joint venture partnerships to leverage on the growth opportunities in this sector.

We should emphasize again that this is a diverse market, and opportunities will differ by product, sector (municipal, industrial) and region. Channels will also differ. In some cases the customer will be the water EPC, and in other cases the end-user. It’s important for a company to understand these before developing the market.