Market Report: Developing Desalination in China

China's economy witnessed tremendous growth after the Chinese market opened up in the early 1990s. As a result, the migration of people from rural locations to urban areas became more significant, especially over the past five years. The expansion and development of 'Mega Cities' and some coastal cities in China (eg. Beijing, Shanghai, Hong Kong, Guangzhou and Shenzhen) has led to a steeply increasing requirement of human resource as well as natural resource supply.

According to a study carried out by the Ministry of Earth Surface Process of China, the urbanisation rate of coastal areas in China is expected to reach 60%-65% by 2030. Considering the average urbanisation rate reached 46.6% in 2009, this is a large increase.

In line with the rapid urbanisation progress, the coastal areas are now also home to major industrial parks in China, including Tianjin Binhai New Area (TBNA) Chemical Industrial Park, Yangtze River International Chemical Industrial Park (YCIP), Shanghai Chemical Industry Park (SCIP) and the China-Singapore Suzhou Industrial Park (CS-SIP). Such relocation of heavy industry from inland regions to designated development zones on the coast will ultimately reduce environmental pressures on inland areas.

As a result of planned power plants along the coast - including renewable sources - there will inevitably be an increase of desalination capacity to copy with the water demand. Nor is it additional power facilities straining China's water resources.

Governmental actions and resolutions

A staggering 400 cities out of 668 in China face the challenge of water scarcity. Coastal areas in particular are the most water stressed with capita water resource of less than 500m3/year - the level that defines 'extremely scarce' by the standard of the UN. These areas account for 13% of the land, 40% of the population, but contribute 60% of the total GDP in China. It is expected that a combined demand gap of 16.6 to 25.5 billion cubic meters for the four northern coastal provinces is foreseen by 2010.

To cope with such water stresses, the Chinese government has set out to measure daily water consumption rates for people in different regions, to control and measure their water consumption with an incentive to avoid the over use of water. The sustainable development plan of 'Water Conservation Society' has been integrated into the 11th Five Year Plan (2006-2010), and will continue to be strengthened during 12th Five Year Plan (2011-2015).

Three important documents including 'China Ocean Agenda 21', 'The Outline of the National Planning for Development of Ocean Economy' and 'The Special Plan for Seawater utilisation' act as the guidelines for the Chinese seawater desalination industry. In particular, 'The Special Plan for Seawater Utilisation' clearly states the current status of coastal water resource, seawater utilisation and the potential for seawater desalination development, investment environment and regional short-term (2010) and long-term (2020) targets for regional desalination and seawater utilisation.

Though the initiatives are positive, there is still a lack of supporting policies when it comes to risk proof mechanisms, allocation of funds or subsidies, as well as mechanisms for developing desalination projects. Market participants need more specific guidelines and regulations to help operate businesses in this field.

China desalination market - market players and production capacity

In China, legislation and development plans determine the direction of an industry. As a relatively young market, the desalination market in China is somewhat centralised but not fully regulated. Two national institutes – The Development Center of Water Treatment Technology and The Institute of Seawater Desalination and Multipurpose Utilization are government led entities, responsible for desalination research and project development.

Key desalination project developers active in the northern and eastern coastal areas are BEFESA, Hyflux, Aqualyng, IDE, Zhonghe and Tsingtao Huaou cooperating with key desalination technology suppliers such as Dow, Hydranautics, Norit, Toray, GE Water, Siemens Water, ERI, etc.

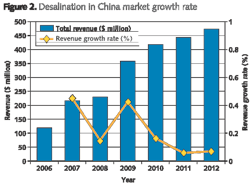

There are 57 desalination projects either completed or in progress with different capacities. The largest one in China now is the Tianjin Seawater Desalination plant for Beijing Power Plant, developed by IDE with a production capacity of 200,000 m3/day.

The largest municipal desalination plant is Tsingtao Befesa desalination plant with production capacity of 100,000 m3/day. The current installed treatment capacity reached approximately 0.43 million m3/day with 1.75 million m3/day under construction. This stands in stark contrast to targets set out by 'The Special Plan for Seawater Desalination and Utilisation', which called for the procurement of up to 1 million m3/day by the end of 2010, and up to 3 million m3/day by 2020.

Two key factors restraining market growth

Key industrial sectors such as thermal/nuclear power plants, steel and metal production plants, or centralised industrial parks take up more than 90% of the overall desalinated water in China. Therefore, desalination plants are normally medium to large scale which need a tremendous amount of investment to support the technologies, engineering and construction involved. So far, privatisation in the desalination plant market is in its developing stage with 70-80% of the projects financed by the industry end users or the government.

Build-operate-transfer (BOT) or Design-build-operate (DBO) modes of business are expected to become prevalent for more municipal desalination projects. So far, the government does not have any direct incentives or funds for desalination projects. Financing is the biggest issue preventing many technology suppliers to tap into the desalination market opportunities in China.

It is estimated that for a 50,000 m3/day desalination plant, the overall investment can be up to U$30 million or more, which is almost three to four times the cost of a water treatment plant with the same treatment capacity. Medium to small engineering or investment companies find it difficult to develop such projects due to a lack of financial muscle. This leaves only companies with strong financial support and experience in the desalination water business to step up and become significant contenders in this market.

Befesa and Aqualyng projects are good examples of innovative financing practice, taking advantage of the 'non-recourse' financing mode that relies 70-100% on local bank loan (Tsingtao Befesa Desalination Plant, 100,000 m3/day, 2009; Caofeidian Desalination Plant, 50,000 m3/day, 2010).

Low water tariffs is also another long-term issue that affects the overall development of the water industry in China. Desalination will only be a financially viable proposition to public utility supply when the water tariff reflects the investment and operation costs.

However, convergence between water tariffs and the cost of desalination is expected during 2011-2015. The current desalination cost is about U$0.6-0.9/m3. Compared to the cost of U$1.2-1.5/m3 for the South-to-North water diversion project, it is attractive for northern coastal areas to relieve the water stress on such a reasonable cost. The cost of desalination rises when the network system expand, so the issue of introducing desalinated seawater into Beijing is still pending for cost evaluation and feasibility study.

Technology trends

Energy costs account for the highest proportion in the overall desalination costs, mounting up to nearly 50%. On the plus side, technological innovation continues to bring down the overall desalination cost. The relatively less energy intensive technology at present is Reverse Osmosis (RO) which is 30% lower than Multi-stage-flash (MSF) and 15% lower than Multi-effect Distillation (MED) technologies.

In the past four years, Reverse Osmosis (RO) technology was the dominant technology applied in China desalination industry except in 2008, when the biggest desalination project (200,000 m3/day) till then was initiated in Tianjin Beijiang Power Plant using Multi-Effect Distillation (MED) technology.

RO is more economically suitable for end-user applications such as high-temperature gas cooled nuclear plants, thermal power plants, chemical and petrochemical plants, and domestic municipal desalination plants when energy can be guaranteed but has potential problems of membrane blockages and needs periodic cleaning. MED is often applied in low-temperature nuclear plant, thermal power plant, steel and metal plants when heat is sufficient to support the distillation. A mixed combination of RO and MED desalination in power plants is another option when cooling, processing or even drinking water supply is needed for the specific project. This hybrid desalination technology is often adopted in centralised industrial parks.

The Chinese government encourages domestic companies to pursue innovate desalination technologies and increase the product quality, lifespan and services to catch up with the international established suppliers and further reduce the overall desalination cost.

At present, the gap in cost between domestic and imported desalination equipment is still significant. Imported equipment is still preferred by large scale project developers, largely on account of the assurance related to stable quality and treatment efficiency.

Growth opportunities

The National Development and Reform Committee announced six key energy-saving fields as the focus in the environmental sector for the 12th Five-Year-Plan. Among them, energy recovery devices and low energy consumption desalination technologies are expected to receive financial support.

The central government is encouraging the development of renewable energy projects (wind-powered/nuclear-powered plants, etc.), in which desalination can be adopted as auxiliary water supply and treatment system. This is to use either the abundant power or heat to generate desalinated water and integrate the energy and water recycling system. Desalination can then benefit from the special fund allocated to renewable energy industry by the Chinese government. Though detailed policies for the desalination industry are yet to be confirmed for the 12th five year plan (2011-2015), it can be expected that favorable policies will become clear and will be translated into city-level goals with regulations on both privatisation and long-term risk proof.

Moving forward

The Chinese desalination market is young with what can be described as immature regulation and market environment. Several demonstrative projects have been established in Northern China coastal areas, which significantly enhance confidence for the government and project developers in the wide adoption of desalination in water scarce coastal areas of China.

The Chinese government is working on establishing guidelines and focused directions to help the market grow in a healthy competitive environment. Water tariff is yet to be adjusted which can really recoup with the project investment and long-term operation cost.

Author's note: Jennie Peng is consulting analyst in the Frost & Sullivan Environment (Water) Practice based in Beijing. For further information on the study please contact Fredrick Royan, Research Director - Water Markets at [email protected].

More Water & WasteWater International Current Issue Articles

More Water & WasteWater International Archives Issue Articles