Satisfied Customers: The Key to Water Infrastructure Investment

By Andrew Heath

Water infrastructure in the U.S. is in serious need of investment. The latest estimates from the Environmental Protection Agency (EPA) suggest that the nation’s drinking water infrastructure needs $384 billion in new investment and our sewage and stormwater systems need another $271 billion just to meet current environmental protection and public health standards.

While the federal government has recognized this issue and recently announced a $1 billion credit to finance more than $2 billion in water infrastructure improvements through a federal-local-private partnership, the program will barely scratch the surface of what’s needed. The reality for water utilities confronting these challenges today is that they are going to need to raise funds themselves, either through rate cases, bond issues or other fundraising instruments.

To do that successfully, water utilities must get smart on customer satisfaction. Unlike the traditional company model whereby a business generates profits and invests those profits in growth initiatives, public utilities often spend money first and then recoup it later if they can demonstrate trust and explain the need for expenditures.

This process is akin to a political campaign by an incumbent candidate that is simultaneously courting the trust of its constituency and angling toward reelection. Just like a political campaign, perception is everything. When customers feel good about their utilities, their requests are approved. When they feel slighted, the outcome is much less certain.

In fact, a 2015 study by J.D. Power and SNL Energy found that electric utilities that ranked in the top quartile of J.D. Power customer satisfaction rankings routinely receive rate increases closer to their request and experience 3-4 percent higher annual profits than utilities in the lower quartiles.

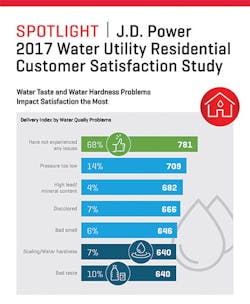

That finding should raise concerns for water utility leaders because their customer satisfaction ratings aren’t great. The 2017 J.D. Power Water Utility Residential Customer Satisfaction Study shows that nearly one-third (32 percent) of customers reported some type of water quality problem over the past year. Among the specific problems reported, low pressure, bad taste, discoloration and scaling/water hardness had the most significant effect on customer satisfaction.

The study, which takes the pulse of more than 40,000 residential water customers around the country, rates overall customer satisfaction on a 1,000-point index across attributes such as delivery, price, billing and payment, conservation, communications and customer service. This year’s overall customer satisfaction score for all 87 water utilities measured was 702. When compared with other service industries, that puts water utilities very close to the bottom of the pack, behind North American airlines (average score of 756) and U.S. mortgage servicers (average score of 755).

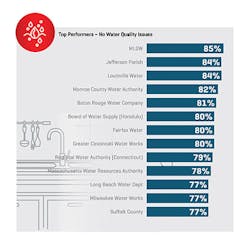

However, by breaking out individual results for each utility, and showing how each performs across the various different attributes measured, we are able to shed some light on what water utilities can do to noticeably improve the level of customer satisfaction.

Among the specific attributes associated with the worst satisfaction scores, bad taste and scaling/water hardness were associated with a 129-index-point decline, bad smell was associated with a 135-point decline and discoloration was associated with a 115-point decline. These had the most significant effect on performance, underscoring just how critical the end product is to water utility customers.

Other areas that have a significant effect on customer satisfaction are affordability, strong customer communications, awareness of environmental and conservation initiatives, and convenience features like electronic bill pay.

Specifically, when customers are aware of their utility’s conservation programs, satisfaction scores leap to 711 vs. 561 among those who have no awareness. Curiously, this holds true whether or not the customer lives in an area experiencing a drought. Likewise, customers who recall receiving communication from their utility or remember hearing about their utility in the news media, have scores that are upwards of 100 points higher than those with no recall. Electronic bill pay is associated with some of the highest scores in the study, with the 30 percent of customers who do receive their water bills electronically giving their utilities an average score of 788.

Taken together, the results of this study offer a roadmap to water utilities on how to solidify the types of strong customer relationships that will be critical as budget discussions heat up. Heading into a challenging period of major infrastructure improvement outlays, water utilities will need to prove themselves up to the task and worthy of the investment. Consistently delivering on the customer satisfaction metrics that matter most will go a long way toward substantiating those claims.

About the Author: Andrew Heath is senior director of the utility practice at J.D. Power. To watch WaterWorld’s interview with Mr. Heath, visit www.waterworld.com.