The modern market for membrane filtration in water treatment celebrates its 20th anniversary this year. We take a look at the latest technical and market developments, including the ‘Open Platform’ concept.

By Dr Graeme K Pearce

Multi-bore fibres have addressed concerns about membrane integrity in the event of excessive flux or unexpected fouling [image credit: inge GmbH]

The membrane market really took off in the mid 1990s, due to the drivers for microbial barriers in drinking water applications but existing for industrial niches for much longer. Initially, membrane prices were high, which restricted their potential use for duties where a barrier technology was mandated. However, new players rapidly entered the market and as manufacturing volumes increased, prices drop sharply. This enabled a broader uptake in the municipal sector and resulted in additional applications in wastewater and seawater reverse osmosis (RO) pre-treatment.

Market growth

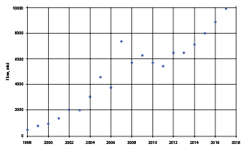

Figure 1 shows the growth in annual installed capacity in membrane filtration, which comprises ultrafiltration (UF) and microfiltration (MF). Drinking water applications in North America drove a sharp uptake in the early 2000s reaching an impressive peak in 2007. The financial crisis then caused a significant drop, but over the next decade, this was partially off-set by the growth in desalination pre-treatment. The figure shows that long term growth trends have now been re-established.

The total cumulative installed capacity is now estimated at 80,000 mld. Though still lagging behind the RO market, growth remains high, particularly for RO pre-treatment which now accounts for 70 percent of UF/MF sales.

Material development

Several different polymers were used in the early membrane filtration market, but as shown in Figure 2, the modern market has been dominated by polymeric offerings of polyethersulfone (PES) in an inside feed format and PVDF in an outside feed format. PES fibres from different suppliers are fairly similar in chemistry and characteristics, but PVDF varies according to whether made by a NIPS or thermally induced phase separation (TIPS) process, and if TIPS, whether modified or not. PES and the different versions or PVDF all vie closely for market share.

Supplier trends

Membrane filtration suppliers quickly optimised their offerings in the early 2000s with differentiated products that were not interchangeable. Though there were many players, typically at least 10 in each regional market, four leading players have dominated market share, namely:

• Asahi (in partnership with Pall outside Asia)

• Evoqua (Memcor)

• Pentair-Xflow

• Suez (formely GE-Zenon).

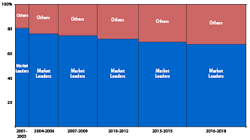

Each of these companies individually has had a ≥10 % share. As a result of this monopoly, module development was limited, but most companies did improve their fibres in this period to provide better strength and integrity and/or higher permeability. However, surprisingly the market became less consolidated over time as illustrated in Figure 3. New players have emerged to challenge the dominance of the original market leaders exploiting new trends in the market.

PES Offerings

PES has the key attribute of high permeability. Unfortunately, it is not possible to take advantage of this fact by using high design flux which would reduce capex, since this would risk membrane integrity. Instead, PES products normally operate at a moderate flux and take the advantage of high permeability by having low energy cost and stable performance with minimal variation of pressure over time.

A key development for PES was the multi-bore fibre since this addressed concerns about membrane integrity in the event of excessive flux or unexpected fouling. In this concept, several lumens are contained in one larger diameter fibre creating a monolith structure. The concept was originally introduced by inge in the early 2000s, but significant share growth did not occur until the BASF acquisition in 2011. Suez has now joined inge with a multi-bore offering, and it is now more likely that the traction of this concept will increase.

Research has shown that it is possible to improve PES with different additives or modified polymers, but so far none of these developments have been commercialised. Instead, the main development by PES module suppliers is to increase the membrane surface area per module. For example, 10 years ago most module offerings fell in the range of 40 to 60 m2, but recently this has increased with one offering of 80 m2. The increase in module size reduces the system cost by 20-25 percent and so the trend has had a marked effect on sales and market share.

PVDF offerings

A similar trend has occurred for Polyvinylidene difluoride (PVDF) with the average module size increasing from 50 m2 in 2007 to 75 m2 in 2017. It is notable for both PES and PVDF that the newer entrants have led the development of larger module size and this trend largely accounts for their increasing market share.

Overall, PVDF has gained share relative to PES, though preferences are application and region specific. For example, PVDF is preferred in North America and PES is preferred for SWRO pre-treatment. Whereas PES is similar from different suppliers, PVDF varies. The original products were based on the NIPS manufacturing process, and this forms products with similar characteristics. The other manufacturing process, thermally induced phase separate (TIPS), produces a fibre with significantly different characteristics, but these can be modified by coating or post-treatment. The robustness of the TIPS fibre has made it popular in North America. Although initially only offered by Asahi (via Pall in the US), there are now several new entrants offering similar products. In response, all of the PVDF NIPS suppliers have introduced improved fibres in the last few years to address perceived shortcomings.

Ceramic offerings

Ceramics have been available throughout the development of the modern membrane filtration market, but until recently, failed to gain traction. The major disadvantage of ceramics is capital cost since the membrane price is high. However, this is balanced by the fact that a high design flux can be used. Furthermore, ceramic membranes have a long life and excellent integrity, both of which reduce OPEX, as well as good fouling resistance and the ability to withstand aggressive cleaning.

Figure 1: Estimated annual installed membrane filtration flow capacity for new projects, mld

Recent developments have seen ceramics address the cost issue by using multi-element vessels. PWNT has several large scale drinking water projects using up to 200 Metawater elements in a single vessel. Other ceramic manufacturers are also targeting drinking water opportunities such as Nanostone and large SWRO pre-treatment duties such as ItN.

It is likely that in the next decade, ceramics will emerge as a legitimate alternative in the water market, and products will be optimised in terms of channel dimensions and membrane area to make then competitive for a wide range of water duties.

The ‘Open Platform’

An important new trend in the US market is to push for a degree of commoditization in the membrane filtration market through the development of the ‘Open Platform’ concept. Two options exist. Firstly, the universal rack development which introduces the potential for interchangeable modules. Secondly, the integrated header concept in which special end caps are used on modules allowing them to be connected directly, eliminating the need for pipework manifolds. For this concept, the potential for interchangeability would be at the rack level. The integrated header is slightly less appealing than interchangeable modules to a user wanting complete control since equipment is still supplier specific. However, the concept has the great benefit of significant cost saving at medium flowrates, and a significant footprint advantage.

In deciding on an approach for system design, a user requires a combination of cost efficiency and stable performance. Also, the user wants to ensure that the module selected for the initial system will keep up with market developments in terms of product improvement, cost, and availability.

The Universal Rack concept provides the opportunity of switching from one module to another supplier at the next change. Alternatively, some suppliers provide an integrated header system in which the rack design is optimised for a specific module. It may be feasible for the rack to be switched to another supplier’s rack at the next module change, though such a change is unusual.

The universal rack can accommodate a variety of different modules. The concept has been warmly welcomed in the US partly due to the strong RO heritage that it imitates, but also due to the route to market influence of engineering firms as project specifiers. Indeed, the universal rack has assisted growth in share of UF products from several of the RO suppliers such as Dow, Hydranautics and Toray.

The bonus of the universal rack is that a module selection could potentially be changed at some point, adding further downward price pressure and protecting the end user from being tied in to a single source of supply. The universal rack has also resulted in a convergence of membrane module size in the range of 70-80 m2 (since modules outside of this range would be incompatible or uncompetitive for the concept). It has also spurred the development of the replacement market, which is aggressively pursued by new entrants such as Scinor. Replacements are now estimated to account for 30 percent of UF/MF membrane sales.

However, the universal rack has some clear downsides, since the design has to accommodate the most demanding option in terms of width and height and will therefore be inefficient for any other choice. Furthermore, the porting arrangement is different for nearly all choices, which would necessitate the use of adaptors. Last but not least, the difference in membrane chemistry and the performance profile of each product as well as variation in the process sequence will mean that it will not be easy or cheap to actually change module suppliers. The universal rack therefore has an associated cost penalty.

Although originally intended for PVDF modules in a vertical orientation, there is potential for the universal rack concept to also apply to PES in multi-element horizontal vessels, since there are now at least three suppliers of compatible products, ie Pentiar-Xflow, inge and Suez.

In the integrated header development, end caps of modules can be directly linked to form the manifold. This trend was first introduced more than a decade ago by among others Omexell of China prior to the acquisition by Dow. Since then, other companies have introduced their own versions of this concept, and in the last few years, the integrated header option has become ubiquitous with many suppliers offering either standard end caps or end caps that can be linked to eliminate manifolds.

Figure 3: Consolidation trends in the membrane filtration market

Conclusions

• The membrane filtration market has continued to grow consistently and currently has an annual installed capacity for new projects of 10,000 mld

• Four market leaders account for about 70 percent of the market, but there has been a steady increase in share of new entrants

• The dominant polymeric materials are PES and PVDF, with PVDF slightly increasing share over time; the different products compete closely, but there are some regions and applications where there is a preference for one alternative, eg PVDF in North America and PES for SWRO pre-treatment

• For PES, the multi-bore development has assisted a growth of share, and for PVDF, increasing module size and development of additional TIPS fibre options has resulted in a growth of share

• Ceramics are beginning to gain a foothold in the market and can be found to be cost effective, but further module optimization will be required before the technology has a broad uptake

• Open platform solutions based on the universal rack and integrated headers have become an important development; some degree of commoditization will result from the universal rack and the growth of the replacement market.

Dr Graeme K Pearce is director of Membrane Consultancy Associates.