Survey Reveals Trends In Water Industry Construction

By James Laughlin

Editor, WaterWorld

Aging infrastructure, regulations and growing populations are leading motivators for construction and rehabilitation projects identified in a recent survey of the municipal drinking water and wastewater industry conducted by WaterWorld Magazine.

The informal survey targeted management-level personnel at the nation's drinking water and wastewater utilities. They were asked to provide information on their capital improvement budgets for the current fiscal year and projected out for five years. They were also asked to describe their plans for major treatment plant improvements, pipeline repair and replacement, automation projects, and the impact of security concerns.

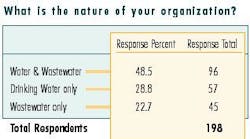

Nearly half of those responding worked for combined water and wastewater systems, with 28 percent working at drinking water-only systems, and 22 percent for wastewater-only systems.

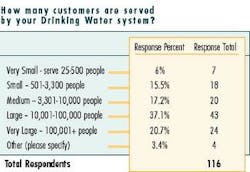

Thirty-seven percent of respondents worked at utilities categorized as "large" — serving between 10,000 and 100,000 people, while 20 percent worked at very large utilities with more than 100,000 customers. Just over 32 percent worked at small to medium size utilities.

Wastewater Treatment

Wastewater treatment plant projects ranged from installation of a headworks to construction of new plants. A significant number of responders reported plans to expand existing treatment plants. Typical projects cited included expanding a 5 mgd plant to 10 mgd, and a 15 mgd plant to 40 mgd. Project costs ranged from below $3 million to well over $100 million.

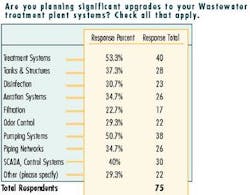

Fifty-three percent of responders reported plans to upgrade their treatment systems, while 50 percent were planning pump upgrades. Forty percent were planning SCADA system upgrades at their treatment plants, while 37 percent were planning tank and structural upgrades. Also cited in descending order of frequency were aeration system upgrades (34.7 percent); piping network improvements (34.7 percent); disinfection (30.7 percent); odor control (29.3 percent); and filtration (22.7 percent).

Other projects mentioned include installation of natural gas generators for back-up power; reduction of ammonia and nitrate output; and solids handling and disposal.

Drinking Water Treatment

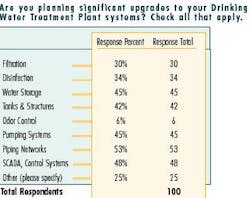

53 percent of responders reported plans to upgrade their piping networks, and 48 percent reported plans to upgrade their SCADA and control systems. Another 45 percent were planning pumping system improvements. Other major systems listed, in descending order of frequency, were tanks & structures (42 percent); disinfection (34 percent) and filtration, (30 percent).

While disinfection was only mentioned by 34 percent of responders, when asked to list "significant" system upgrades, many of the survey participants listed disinfection system improvements. Projects included addition of disinfection at well sites, enhanced disinfection monitoring, and modification of disinfection systems to move away from chlorine as the primary disinfection. Specific systems mentioned included UV, ozone and on-site disinfection systems.

A number of responders also mentioned plans for installation of reverse osmosis membrane systems and other filter upgrades. Other projects mentioned included installation of back-up generation systems, sludge handling upgrades and drilling of new water wells.

Automation Projects

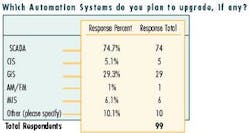

When asked about their plans for automation projects, 74 percent of responders listed plans to upgrade their SCADA systems. Another 29 percent had plans to upgrade or implement geographical information systems. Interestingly, only 5 percent were planning automated customer information system projects. That number seemed low in light of the recent industry push to improve customer service.

When asked to describe their most significant automation projects, a number of responders cited plans to replace or upgrade aging SCADA systems. Several were planning to switch from RTU-based systems to PLCs. They also reported plans to upgrade software and communication systems, and install enterprise management programs. One utility did mention plans to spend $4.5 million over three years to install a new customer information system.

Automatic Meter Reading

The majority of responders reported no plans to upgrade to automatic meter reading. Many reported they had already installed touch read systems and planned to go no further at this time. Others said they had researched installing an AMR system, but funding was not available to proceed.

For those planning AMR projects, the majority were planning drive-by radio read systems. Eleven percent of responders were planning walk-by reading systems, and 2 percent were planning cellular-based reading systems. While cable and telephone-read systems were listed as an option in the survey, no utilities reported plans for AMR systems based on those technologies.

Fifty-one percent of those planning AMR projects said they expected to spend less than $100,000 in the next five years. 22 percent expected to spend between 500,000 and $1 million, while 11 percent expected to spend over $1 million.

Security

While security continues to be a significant concern in the municipal water industry, the dollar figures earmarked for security remains small in comparison to other infrastructure projects. Nearly 50 percent of survey participants reported plans to spend less than $10,000 on security systems in the current fiscal year, and nearly 60% planned to spend less than $50,000 in the next five years.

Clearly, spending is dependent on the size of the utility, and very large utilities make up a tiny percentage of the industry. Approximately 3 percent of responders reported plans to spend in excess of $5 million over the next five years, and 8.4 percent reported spending ranging from $500,000 to $5 million.

Typical security upgrades included fencing, gates, close-circuit television systems, motion detectors, security lighting, and stepped-up police patrols. Many utilities had either just completed their vulnerability assessments, or were still working on them and had not established their budgets for security.

Some automation system upgrades such as process monitoring and improved communication systems could also be used to enhance security, but were not listed specifically as "security" upgrades.

Distribution Systems

Distribution system projects ranged dramatically in price, depending on the size of the utility and the state of their infrastructure. One utility cited plans to install more than 400,000 feet of new water main as part of a major expansion project, while another planned to installed only about 2,000 feet of 6" and 8" mains.

Several utilities were planning expansion projects involving installation of new lines, but many more cited plans for replacement and repair projects. Specific projects included replacing cast iron mains with PVC pipe, replacing concrete mains with steel, and lining of deteriorated pipe. A number of utilities were also planning to replace existing pipe with larger diameter lines to increase flow and improve service.

Other projects listed under the distribution system improvements were construction of water towers and tanks; installation of floating covers over treated-water storage reservoirs; and pumping system upgrades.

Collection Systems

Concerns with sewer system overflows, capacity issues and infiltration & inflow were all mentioned in the collection system portion of the survey. Again, projects ranged dramatically in price depending on the utility.

A large number of utilities were planning pipeline replacement and repair projects, while a lesser number were planning to install new collection system piping. Specific types of projects mentioned including pipe bursting programs; sewer line enlargements and upgrades; and installation of new vacuum sewer systems in challenging areas.

Pumping system upgrades were frequently mentioned, with costs ranging from $2 million to more than $70 million. Sewer system assessment projects, identifying and correcting infiltration, was a major line item. One larger utility reported plans to spend $230 million on a system-wide program to identify and eliminate wastewater system overflows.

While other projects were less aggressive, utilities reported plans to buy CCTV equipment for video inspect of sewers, and sewer cleaning equipment to help maintain flows.