Measuring the Horizon for Latin American Water & Wastewater

By Patricia Pietravalle and Alex Shtogren

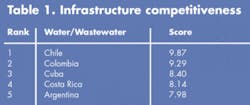

This December CG/LA Infrastructure released its “2nd Annual Rankings of Infrastructure Competitiveness in Latin America.” We assessed the six quantitative indicators directly related to water infrastructure as well as a series of indicators specifically focused on the policy, management and economic environment. Though infrastructure development is long-term in nature and doesn’t vary dramatically from year to year, several countries – namely Brazil (up 12%) and Peru (up 21%) – have improved their scores since 2006, and we expect more region-wide progress in the immediate future.

In terms of infrastructure competitiveness, Latin American performance in the water and wastewater/sanitation sector is challenged. Investment in water and wastewater systems (including maintenance and rehabilitation), only reaches 0.12% of the region’s GDP – a very low figure compared to UN Millennium Development Goals (MDGs). These MDGs state that the investment should be 1.2% without taking into account maintenance and rehabilitation. System-wide unaccounted for water (UAW) loss can run 50%-60%.

Increasing transparency and “Measure to Management” initiatives, however, are driving investment of scale across the region, including the following programs, which will modernize public utilities and guarantee substantial investments in the water sector:

Brazil – Brazil’s Growth Acceleration Program (PAC), which will direct US$2.5 billion into infrastructure projects, with notable water and wastewater examples in the Brazilian Northeast. Along with Spain, Brazil will also be party to the “Potable Water Support Fund” will supports the expansion of water services in several countries (mostly in South America), with total project estimate of US$1.5 billion.

Andean Countries – A US$200 million loan agreement between the Andean Development Corporation (CAF) and Peru’s Ministry of Housing targeting the water sector. (Peru ranked 15th out of 23 in our rankings). The IADB also approved a US$ 100 million loan to Peru last year to support sanitation. According to the Ministry, roughly US$400 million is needed to invest yearly in order to reach the MDGs.

Mexico – Mexico’s recently implemented Fonadin fund is a restructuring of the Fideicomiso de Apoyo al Rescate de Autopistas Concesionadas (FARAC) and Fondo de Inversión en Infraestructura (FINFRA) funds and will deliver US$266 million a year through 2012 to strengthen Mexican municipal water service providers. Overall investment in water and sanitation during President Felipe Calderón’s administration, which ends in 2012, is expected to be more than US$1.6 billion.

Moreover, consistent with results of this year’s CG/LA rankings, we’ve seen several promising overtures to the private sector, including an announcement at the 6th Annual Latin American Leadership Forum in Miami in April, by the water authority of Rio de Janeiro, CEDAE, that it will make an initial public offering at 2008’s end. São Paulo, Brazil, executed the state’s second public private partnership (PPP) last month to upgrade sanitation facilities in SABESP’s Alto Tiete complex, and Peru will be hosting international investors July 17-18 for “Peru: Construction, Housing and Sanitation” to showcase the US$2.2 billion in Peruvian housing and sanitation projects targeted through 2011.

Though there wasn’t a paradigm shift in the water sub-rankings between 2006 and 2007, we expect, based on the above projects and funds dedicated to water infrastructure, that the upcoming “Annual Rankings of Infrastructure Competitiveness in Latin America” will tell a very different story. Performance contracting will need to play a major role in order to solve the very central problem of unaccounted for water loss.

All in all, we see the region gaining dynamism in financing of infrastructure projects, with new schemes being adopted to build, construct and maintain water and wastewater systems. We expect this trend to continue, as urban populations grow and private water companies (especially Spanish and French ones) push hard to increase their participation in the market.

About the Authors:

Patricia Pietravalle is vice president for Global Rankings projects at CG/LA Infrastructure – a market research and strategy consultant with offices in Washington, DC, and São Paulo, Brazil.

Alex Shtogren is vice president of sales and marketing for CG/LA’s Infrastructure Leadership Forum event series as well as its Infrastructure Rankings.