Digitalisation is changing the relationship between utilities and their customers, morphing isolated suppliers into connected service providers. We take look at the key technology and market trends expected this year.

By Will Maize

Faced with mounting challenges involved with supplying water to the world’s growing cities, water utilities are turning to new – “smarter” – technology offerings, which have the potential to revolutionise water service delivery like never before.

Smart water can be broadly defined as a group of emerging technological solutions that help water managers operate more effectively. Smart water solutions harness state-of-the-art hardware and software solutions to provide increasing levels of system intelligence, visibility, automation and control, while enhancing customer service through new channels of engagement. These technologies are increasingly being delivered via new business models, like software-as-a-service (SaaS), or through the cloud.

Smart water developments across global municipal water markets are shaped largely by local drivers such as water scarcity or regulatory requirements, and market dynamics such as rate structures, cost recovery and privatisation. As such, while innovation is happening across the utility operating footprint, specific technology verticals are advancing at different paces in different regions.

Customer-centric platforms

The broader trend of digitalisation is changing the fundamental relationship between a utility and its customer, morphing an isolated supplier to a connected, service provider. Customer-centric platforms in water were largely born out of the seven-year drought in the western US, as software companies recognised an opportunity to harness technology to help lead conservation programs. Platforms like Dropcountr and WaterSmart are good examples.

Increasingly, customer-engagement platforms should see demand growing in markets overseas. Evolving the customer service is also at the forefront of UK water regulator Ofwat’s plans for the next five-year investment period, 2020-2025. In 2017, WaterSmart secured its first contract in the UK, inking a deal with South Staffs Water, while UK-based competitor Advizzo has already secured agreements with Anglian Water, Severn Trent, and South East Water.

Dealing with high water and energy consumption rates amid an arid, water scarce environment, Dubai Electricity and Water Authority (DEWA) has also engaged with Advizzo. DEWA will use Advizzo to drive digital customer engagement efforts through email and SMS. The system went live in early 2018.

Smart metering (still) the flag bearer

Smart water metering systems help increase the collection frequency of data, enabling new forms of customer engagement and billing, and more visibility into network performance. In 2017, new deployments of advanced metering infrastructure (AMI), defined as two-way, fixed radio or cellular communications network, outpaced walk-by/drive-by systems (AMR), signaling a growing business case for AMI over AMR.

Traditionally, advanced metering infrastructure players have paired smart water meters with proprietary communications solutions, locking in utilities into multi-year contracts, vendors limit competition for complimentary network devices. From a utility´s perspective, however, reduced flexibility in procurement compounds the challenge to communicate a clear return on investment for AMI projects to justify rate increases.

The emergence of the internet-of-things (IoT), emerging low power wide area network protocols (LPWAN) such as Sigfox, LoRa, and NB-IoT, have added to the complexity of the procurement process for municipal utilities. On the one hand, LPWANs tempt utilities with lower total expenditures (low transmission and network costs) and offer meter battery life-spans of 15 to 20 years – both vital components in a strong metering business case. On the other, uncertainties around the commercial longevity of Sigfox and LoRa have only served to increased interest in their long-awaited, licensed-spectrum cousin, NB-IoT.

Australia provides an interesting case study in how uncertainties around communications protocols have affected smart metering developments. Electing to go with a proprietary communications option, in July 2017 Cairns Regional Council awarded a US$12.2 million contract to Itron to replace its 53,000 water meters with its proprietary AMI, ultrasonic meters, and meter data management platform.

In contrast, a consortium of three Victoria utilities (City West Water, South East Water, and Yarra Valley Water) announced they would extend trials of smart water meters and communications technologies by 18 months.

Uncertainty regarding the time-frame of a fully deployed, commercially available NB-IoT protocol has translated into uncertainty in making a commitment to unlicensed protocols (LoRa, Sigfox), or waiting for NB-IoT or potentially even 5G.

We expect AMI to continue to command the lion’s share of new metering announcements, driving a market of US$17.1 billion over the next decade, in the US alone.

Leak detection and non-revenue water management remains a key focus priority

Globally, water lost through leakages and pipe bursts remains a top priority for utilities looking to make investments in new technologies. Network owners and operators are increasingly looking to reduce reliance on legacy technologies and methodologies, such pipe replacement or network sweeping, with more sophisticated, smart solutions involving communicating sensors, advanced imagery, and data analytics.

Segmenting the smart water offerings into the International Water Association (IWA) designated ‘four component approach’ to address real losses, we expect the following technology innovations to scale up in 2018.

Active leakage control

Processes used to identify and pinpoint (and then repair) water leaks have evolved along diverging lines, globally, related to the district metered areas (DMAs). Propagated from within the UK, DMAs have become a common tactic to tackle leaks on the distribution system. However, commonplace across many global markets, from France to Australia, the US market has largely excluded the use of district meter areas, to date. This has impacted smart water vendors which developed solutions involving the data flows which DMA systems provide, leading to a paucity of opportunities in the US.

In what could be a signal to this dynamic changing, in the spring of 2017, Israel-based TaKaDu landed its first contract in the US, inking a deal with Knoxville Utility Board (KUB). The utility will deploy its event management system to help improve customer service and address non-revenue water. Matchpoint Inc., TaKaDu’s partner on the project, was central in implementing a district metering strategy at KUB.

Detecting leaks from above is another trend that should continue to see market demand in 2018, expanding on the multiple pilot and commercial developments announced in 2017. Israel-based Utilis and UK-based Rezatec are two firms offering leak detection via satellite technology. Severn Trent in the UK has been actively trialing both technology vendors, in parallel with a pilot involving drones, to drive efficiencies in network sweeping and leakage pinpointing.

Finally, fixed leak detection has seen an uptick in large-scale deployments in recent years, which should continue. Switzerland-based Gutermann will deploy an additional 3,500 devices with Veolia in Grand Lyon in 2018, building on its 6,000 devices already in service. Grand Lyon has seen its non-revenue water fall to 15 percent in 2017 from a high of 23 percent in 2014. Meanwhile, in the US, in April 2017, Echologics secured a deployment for 10,000 fixed leak sensors with San Jose, California, was also notable.

asset management

In a move towards its plans to establish a smart distribution system, in 2017 South West Water in the UK announced plans to deploy up to 4,000 dNet sensors from UK-based pressure management specialist i2O, as well as 250 pressure reduction valve condition monitoring loggers, and i2O’s iNet platform. The utility will use the technology to monitor valve condition, flow, pressure, and transients, across its network, while optimizing energy efficiency for pumping operations.

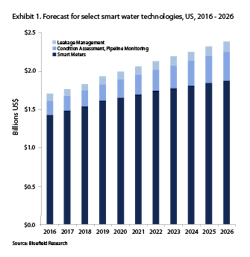

As financially constrained utilities seek to extend asset service life and defer capital-intensive pipe replacements, asset data is increasingly used to make informed, data-driven replacement and pro-active maintenance decisions. The recent acquisition of Pure Technologies by water pure-play Xylem reflects strong market sentiment towards this growth opportunity, as Xylem looks to round-out its smart infrastructure portfolio. We anticipate that the market for these technologies will double by 2026, totaling over US$2.7 billion in the US alone.

Sitting on top of the data collection level, nascent start-ups like California-based Fracta are applying machine learning techniques to water utility’s historical pipe and operational data sets – material type, age, soil condition, pressure, etc. – generating insights into asset risk profiling. These insights can inform more targeted active leakage control regimes, or capital replacement planning processes.

game-changing tech

Applied to storm or combined collection systems, real-time control has been proven as an effective alternative to capital intensive storage capacity expansions, and has the potential to save millions. Companies like OptiRTC and EmNet have completed multiple projects across the US.

Canada-based EMAGIN, and US-based Pluto AI are on the forefront of applying machine learning and big data analytics techniques to modernise the way plant operators perform their jobs, track asset performance, and make optimised decisions.

The confluence of modeling platforms with network management software, all fed by real-time data, would enhance all aspects of the utility operating model. Players that are positioning for this market include Innovyze, Bentley Systems, Siemens, Schneider Electric, General Electric, among others.

digitally-savvy utilities

As utilities increasingly ingrain data-driven decision making into operations and planning processes, the competencies and business models of the engineering consultancies that serve them are forced to evolve. Project-based work flow traditionally outsourced to engineering firms, from hydraulic master planning to capital investment plans, will face disruption as more advanced modelling and analytics software are developed. Fed by real-time network data, hydraulic or asset management plans can be constantly updated to provide utility operators and CFOs with an optimised operating and investment schedules.

While most engineering firms recognise the growing importance of digital solutions in their offering to municipal water utilities, they diverge in their approaches to address the nascent smart water opportunity, with examples ranging from acquisition to in-house development and partnerships. This divergence is in part influenced by an immature, fragmented landscape of solutions providers, but also due to incompatibility between traditional, hours-based business models of EPCs, with license and services-based approach of a software vendor.

As smart water segments continue to mature, we can expect more EPCs to re-position toward utility clients through acquisition. A recent example came in early January 2018, when Arcadis added SEAMS to bolster its data analytics software capabilities for strategic asset management. SEAMS has gained traction in the complex regulatory environment of the UK water sector.

Drawing investment

Investment in smart water technologies is driving M&A in the water sector. In 2017, a landmark deal established a new benchmark for smart water M&A, when private equity firm EQT bought network modeling and business analytics platform Innovyze for US$270 million, a 16x EBITDA. Three months later, EQT had announced a rolled-up Innovyze with its portfolio company (a former competitor to Innovyze) XP Solutions. XPV Water Partners performed a roll-up of its own, funding Aquatic Informatics’ merger with WaterTrax and Linko.

The 2017 acquisitions of competitors Silver Spring Networks and Aclara Technologies, for US$830 million and US$1.1 billion, respectively, reinforce the importance of communications networks within the context of smart water and more broadly smart cities. And Xylem’s announced the acquisition of Pure Technologies, for US$397 million, a 17x EBITDA, is an extension of its strategy to become a leading smart water solutions provider, building on its acquisitions of Visenti and Sensus in 2016.

Overall, such activity should provide optimism about the scaling opportunities for smart water technologies, globally.

Will Maize is a research director for Bluefield Research. He can be reached at wmaize@bluefieldresearch.com. Learn more at www.bluefieldresearch.com

smart water

Global Utility Perspectives

Water utilities are increasingly open to adopting and leveraging the use of smart water and wastewater technologies in their efforts to address an array of internal and external challenges. With global utilities taking an active role in shaping the future of the water industry, 2018 is poised to be even more exciting. Below, four senior global water utility leaders share their unique perspectives on what lies ahead for smart water.

Jens f. bastrup, ceo of skanderborg utility, denmark

Utilities must not only implement strategies focused on improving internal capabilities, but should also actively reach out to various stakeholders to co-create, test and pilot technologies. With this in mind, Skanderborg initiated the partnership – AquaGlobe with knowledge institutions, the public, and private companies including leading Danish water companies Grundfos and Kamstrup. This initiative is essentially a living lab and a show-room that welcomes partners with customers, showcasing their solutions in real-time. It’s where new technologies and systemic solutions are co-developed, tested and implemented in real life and with a real-life mindset. Such partnerships help eliminate ‘silo solutions’. Water is going smart. Therefore in 2018, more communities for smart water partnerships will pop up within and across borders.

Tomi Lukkarinen, automation engineer at Helsinki Region Environmental Services Authority (HSY), Finland

Many new smart water technologies will disrupt the old way of working. A recently completed state-funded smart water project consisted of many proof of concept and pilot projects, aiming to enhance quality of water services. During the project, many new technologies were tested, including automatic problem detection in CCTV footage, data analytics on sewer flows, different IoT devices in the sewer network and laser scanning of wells. The most successful projects all had two things in common: they used large amounts of data and the solutions were co-created in an agile way with a new technology vendor. While some utilities, including HSY, have already adopted smart water solutions to their operations, most are still in their starting blocks. In 2018, new disruptive smart water solutions will challenge the water sector incumbents and the old, business as usual tactics.

Ting Lu, principal engineer at Clean Water Services in Oregon, US

The future of water infrastructure optimisation requires the following three converging areas: (1) the affordability of real-time sensing technologies to provide watershed-scale monitoring to produce quality data and transform data into actionable information to drive decision-making; (2) the application of artificial intelligence to maximise the value of data to generate additional results and (3) prioritization of the interoperability and reliability. At CWS we were able to capture, synthesize, and analsze drone-based imagery to extract key land use insights. The future digital water utility will require a system centered on interoperability and reliability to provide for system information, data quality control, and effective decision-making. Such efforts will also help reduce instances of “dark data”, hidden in the corners of the organisation with poor quality and limited visibility.

Rogério de Paula, director and vice-president of institutional relations at AEGEA, Brazil

The National Water Agency will need to have increased authority to effectively coordinate and create national sanitation regulatory standards. This positive change, which is currently being reviewed by the Brazilian government, could reduce disparities in the way different operations are subject to regulatory interpretation, offering public and private sector operators greater legal security and helping to boost investment in sector modernization. Additionally, there is a move towards calling for more mandatory tenders between public authorities and state-owned companies, a positive move for the industry. Overall, greater regulatory security could support efforts to improve service efficiency, providing universal access and offering the public with high quality services in Brazil. We need to be forward-thinking to more effectively address our water and sanitation challenges.

The above cross-industry trends have been shared by Smart Water Network Forum (SWAN) member utility leaders who will be presenting at the 8th Annual SWAN Conference on May 21-22, 2018 in Barcelona. For more information, visit: www.swan2018.com