Latin American investment in water infrastructure must triple, says CG/LA

CG/LA Infrastructure study reveals that Latin American governments have under-invested in water and wastewater infrastructure for 15 years, although overall investment continues to grow.

by Norman F. Anderson

Opportunities in the Latin American water and wastewater sectors are promising, but the region’s lack of significant investment in infrastructure is detrimental to its economic performance.

CG/LA Infrastructure recently finished a six-month study of the sector as part of its overall assessment of Latin American infrastructure. The report “Ranking: Infrastructure Competitiveness in Latin America” provided clear documentation that proves national governments have been under-investing in the sector for the last 15 years. This trend cannot continue.

Water and wastewater investment in the region continues to grow, particularly in projects focused on increased productivity. New governments recognize that investment is too low; total water and wastewater investment in the region totals only US$18 billion, a level that needs to be at least tripled to the $60 to $70 billion range if infrastructure levels are to be improved to a satisfactory level of performance.

Newly elected governments throughout the region have made significant promises to their people in the areas of clean water provision, sanitation and wastewater treatment. Once in office, government leaders meet the realities of the situation - having to design, and above all, finance highly complex projects with little in the way of readily available resources. Real areas of opportunity are in large wastewater treatment projects financed by international institutions, and in local “disaggregated” opportunities developed by local engineering firms.

Survey ranking

The study ranked Latin American countries by assessing a series of six indicators directly related to water infrastructure: coverage of clean water and sanitation; wastewater treated; unaccounted for water loss; infant mortality rate; and investment in water-related infrastructure as a percentage of GDP); in addition to a series indicators specifically focused on the policy, management and economic environment.

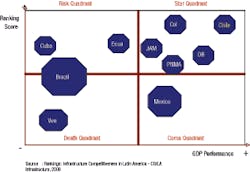

The results were very important from a business demand point of view. Chile leads the region with a total score of 9.24, followed by Colombia with a score of 8.51. Both countries engaged in intensive and well-organized efforts beginning in the mid-1990s to upgrade their water systems, and to inject significant investment into the wastewater treatment sectors. Chile continues to move ahead with a significant private concessions program.

The big markets of Brazil and Mexico, sources of potentially huge business opportunities, did not score well in our rankings. Brazil came in ninth overall (total score of 6.41), suffering through very low levels of investment caused by problems with the national regulatory model. Mexico scored 17th overall (total score of 4.78), having failed to develop a workable investment model in the water sector during the six years of the President Vicente Fox government (2000-2006).

The five lowest-ranked countries in the region were, from lowest to highest, Haiti (1.05); Nicaragua (3.10); Venezuela (4.25); Paraguay (4.31); and Bolivia (4.52). Virtually no water-related business opportunities exist in these countries because of systemic problems, such as very low per capita income. For complete rankings, visit the website: http://www.cg-la.com/rankings.

Notable opportunities

Overall investment levels are extremely low -- averaging between 0.1% of GDP and 0.4% of GDP (levels need to reach a minimum of one percent of gross domestic profit (GDP) and stay at that level for at least five years), but a series of projects are serving to galvanize specific country efforts.

The newly installed Mayor Marcelo Ebrard of Mexico City identified water as his top priority, setting targets of drastically reduced unaccounted for water (UFW) and aggressively investing in water treatment plants. UFW is as high as 50 percent in the capital city of Mexico. Private sector performance contracts will be a featured participant in this effort. The mayor also plans to modernize the water company of Mexico City.

In Brazil, the São Paulo state water company SABESP is launching the first water-related public-private partnership (PPP) in the country. Its aim is to double the capacity of the Alto Tiete water treatment plant. Total value of the project is $170 million with five additional PPPs soon to follow. SABESP invests approximately $500 million per year in capital improvements.

In Peru, the new government of Alan Garcia launched the new program Water for All, designed to increase the level of investment in the country’s water sector to $360 million/year, targeting a total of two million new water and sewer connections.

The Japanese bilateral aid agency (JBIC) funds a series of wastewater projects in Central America and the Caribbean that will generate highly significant activity in those countries through multi-year investment projects. JBIC projects are underway, or about to get underway, in Panama ($240 million Panama Bay Clean-up); Costa Rica ($150 million San José Wastewater Treatment); and the Dominican Republic ($120 million Santiago Wastewater Treatment).

Real pockets of opportunity exist, although the region as a whole is underperforming its potential.

Rankings reveal need for public sector investment

The Rankings Report shows that the public sector throughout the region needs to focus on new ways of investing in the water sector. Tariff levels are generally solid. Gross inefficiencies pose serious problems with low payment rates, UFW rates up to 50%, and extremely high employee/connection numbers. Three trends describe where the business will be:

Trend #1 - Productivity Enhancements: Increasingly new and interesting projects are being developed with a focus on performance contracts, in which the private sector takes the risk of installing new metering systems, taking over the billing and collections systems, and even detecting leaks and installing new pipes. The focus is on increasing and expanding the productivity of existing assets.

Trend #2 - Private Management: Another interesting trend, as privatization disappears as a management strategy, is the identification of private sector managers to run public utilities. This trend began with São Paulo’s SABESP in 1995, and the work done by Ariovaldo Carmignani over eight years turning the company from a money loser to an aggressive modern company quoted on the New York Stock Exchange. A number of public systems around the region are hiring private sector managers to run their “companies.”

Trend #3 - “Measure to Management” Initiatives: Lastly, water systems are beginning to measure critical metrics - including UFW, employees per connection, and revenue per connection - and manage to those metrics. This creates not only new levels of productivity, but also creates the kind of transparency that drives investment decisions - as citizens demand better performance for the significant monies they pay in water tariffs.

CG/LA Infrastructure foresees increasing growth in water and wastewater investment in Latin America, particularly in projects focused on increased productivity. New governments in the region recognize the fact that investment is too low - we estimate total water and wastewater investment in the region at only about $18 billion, a level that needs to be at least tripled to the $60 to $70 billion range if infrastructure levels are to be improved to a satisfactory level of performance.

Author’s Note

Norman F. Anderson is the president and chief executive officer of CG/LA Infrastructure, and is based in Washington, D.C., USA.

CG/LA Infrastructure Update

On December 15th, CG/LA will release its “Business Report for the Infrastructure Rankings, a strategic planning tool for private sector decision-makers seeking intelligence on top infrastructure projects in Latin America. Based on the results of the Rankings, the report identifies the hot targets and career quicksand, in terms of projects, companies, and sectors.

Tailored for the busy executive, the Business Report packages 20 projects from seven sectors, including water and wastewater, in a clean, concise format, that captures the hard facts: the dollar value, financial structure, business opportunities and project timeline. An “x-ray” of each project’s strategic value, coupled with a bottom line analysis, provides executives with a roadmap for regional opportunities.

Additional intelligence includes public and private infrastructure investment and spending trends as well as a listing of cutting-edge and innovative infrastructure companies operating in the Latin American region. The projects and companies have been selected from CG/LA’s three proprietary knowledge bases that maintain over 50,000 companies, executive decision-makers and projects involved in infrastructure innovation.

For further information about CG/LA Infrastructure Rankings and Business Report, please visit www.cg-la.com/rankings.htm

CG/LA also hosts the Annual Latin American Leadership Forum, a marketplace for regional infrastructure opportunities. Like the Business Report, the Leadership Forum provides a consolidated outlook for the region by bringing its top projects, including water & wastewater, in one place.

The 5th Annual Latin American Leadership Forum will take place March 14-15, 2007, in the Dominican Republic. For further information, please visit www.cg-la.com/lalf5.htm. Registration is possible online, and pre-registration ends December 31.