East to West: the Future of Water?

There is now a continued shift in focus from West to East in the global water market. New players and countries are emerging on the scene and there has been a boom in the exportation of services and technologies from China and Singapore. As a result of the Westward shift, the five dominant forces of the water sector have subsided. These are a few of the headline findings from infrastructure law firm Pinsent Masons' 12th Annual Water Yearbook, which set out to identify a number of key global trends in its scan of the sector. So what else was found?

Millennium Development Goals (MDGs)

On a macro scale, the book points to some unchanged trends such as industrialisation in the world's developing economies, which fuels urbanisation, particularly in Asia and Latin America. At the humanitarian level, while hailing the UN's resolution on water as a human right as a great step forward, the book also points out that the MDGs have a long way to go - a regrettable fact being identified by a growing number of experts in the water and sanitation field.

The UN itself believes that while the water element of the MDG will be met or even exceeded, the sanitation target is very likely to be missed. The book warns on both that "the economic crisis may create setbacks and progress is uneven across the goals, and the main cause of such unevenness appears to be the highly variable quality of governance".

Pinsent Masons' partner Mark Lane, who heads the company's water group, identifies a pressing need to re-launch the World Water Vision's target of universal access to water and sanitation by 2025 as it is clear that the water and sanitation targets for the 2015 MDGs will only be partially met.

"Much work needs to be done to convince people that investing in these assets and services makes good economic sense, especially in a recession," he says. Discussing the yearbook findings, he adds: "We started 13 years ago, and back 12 years ago when we published the first yearbook we did the whole world in 500 pages."

Since then, the market has become much more fragmented and many more local players have become involved, so the company decided that looking at the whole world in one issue was unmanageable, he explains. The book has therefore been split into two on the basis of looking one year at the EMEA countries (Europe, Middle East, Africa) and the next focusing the analysis on North and South America, and the Asia-Pacific region (the current issue).

"Because of the way the yearbook is configured, part one, The World of Water, is global and the company analysis of major players is global, so we get a global flow," Lane observes.

In terms of key messages he picks out "a development of more optimism than hitherto, clearly private participation in the water sector is alive and well and new players continue to emerge".

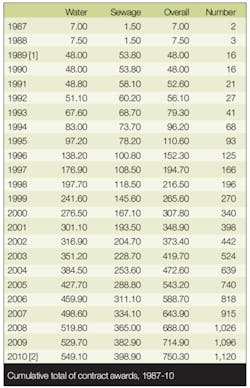

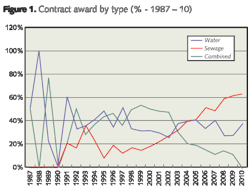

Private Sector Progress

Looking at the private sector participation (PSP) market, the rise in the number of people served by private players – 12% of the world's population, some 862 million people – is an increase of 60 million on last year. However this is not accompanied by an increasing rise in share by the 'big five' companies – Veolia, Suez, Agbar, RWE and Saur, whose dominance is now described as a "distant memory". These companies now hold 32% of the market compared to 71% in 2001.

In a trend identified last year, the Yearbook has pinpointed a narrowing gap between the 927 "top tier" companies, which cover 695.7 million people and the growing force of "second tier" companies, often local players, that now cover 54.5 million people.

The book's author, David Lloyd Owen of environmental consultancy Envisager, sums this up as the key message of this year's edition.

"Momentum for PSP continues to be mostly outside the OECD countries, especially in China, Brazil, India and Russia (the BRICs) with most new projects being managed by local, rather than international companies.

"At the same time, companies from South and East Asia are making their presence felt internationally, with for example Japan's Mitsui, Marubeni and Mitsubishi stepping up their activities, with government support."

The yearbook raises the question of whether China's expansion is going global (discussed further below), as Lane observes: "Japan has ramped up enormously – it has pumped $1.2 billion into funding for projects in developing economies, a major statement of intent that it wants to become a major player."

The country section provides detail on the Japanese expansion: "Mitsubishi holds 5% of the United Utilities consortium serving eastern Manila and is AWG partner for the Beijing No 10 water BOT. Marubeni also has a JV with Veolia Environnement for a variety of projects in China and other East Asian economies. Marubeni is Vivendi's JV partner for the Chengdu BOT water supply project in China. Mitsui and Sumitomo both have a 7.5% stake in Thames Water's Izmit project in Turkey."

With the recession still continuing to plague the market, Lane warns of a higher than expected attrition rate in contracts being cancelled ahead of time. This issue is identified in the yearbook's overview of World Bank (see pages 16-17) water and sewerage PSP lending, where 64 projects (34% of total investment) are identified as "cancelled or under distress".

The yearbook adds: "The distress level of 34% (29% in the 2008 survey) compares poorly with Electricity (8%), Telecoms (3%) and Transport (8%). It is also below the 31% level in 2006. While the quality of the World Bank's overall water and sewerage lending portfolio has improved in recent years…problems in South East Asia and Latin America are reflected in the very high rate of funding covered by projects either cancelled or under distress."

The number of projects invested in has eased upwards, it explains, with a recent shift away from Latin America to East Asia, and a constant level of activity for Eastern Europe and Central Asia. The yearbook also observes that in contrast to the number of projects, the actual funding has not recovered to the levels disbursed between 1993 and 2000, with the most dramatic decline in East Asia, though it has bounced back from the 2001-2002 low.

In Europe, the situation appears relatively static. The book notes: "In Europe, the emphasis is currently on organic growth and gaining contracts in Central and Eastern Europe (where EU subsidies can be mobilised). The three priority markets in Central and Eastern European are the Czech Republic, Hungary and Slovakia."

The Big Five subside

Looking at the "big five" major players, the yearbook reports the world's leading international player, Suez Environnement, as having eased back on its developing country contracts while continuing to expand in Europe, North America, India and China.

Veolia Water Services points, in response, to its CEO Jean-Michel Herrewyn's statement on the company's performance in its own financial report.

"I would say that 2009 was a satisfactory year, even though the recession obviously impacted our business. Financially, the economic climate interrupted the strong growth we had seen over the previous years because clients were forced to postpone projects," he said.

"Our industrial clients were directly affected by declining production, while our public authority clients had financing problems. But for a company like ours, difficulties always mean opportunities. In keeping with Veolia Environnement's strategy, we thoroughly reviewed our activities and made numerous improvements: we exceeded our targets in cost reduction and proved that we could achieve positive cash flow from our activities to finance our growth."

He added: "Many public authorities therefore chose to renew our contracts. One example is Mafra, Portugal. Another is Bucharest, Romania, where a trusting relationship between our people and the municipality resulted in the signing of an important amendment to the 25-year contract between us, which began in 2000."

Agbar and Sembcorp

One of the big five companies, Spanish giant Agbar, is probably listed separately for the last time in the yearbook due to its agreed takeover by Suez Environnement earlier last year. Demonstrating the complexity of the relationships between companies, Agbar bought UK water-only Bristol Water in 2006, moving outside its traditional foreign acquisition territory in Latin America.

Given the retrenching of the major players, it is exciting that the yearbook identifies a new major player - one that created a significant stir in the market earlier this year. "Singapore has gained a global player in SembCorp, which bought Cascal from Biwater," Lane notes.

Sembcorp's rise is first hinted at in the yearbook snapshots from around the globe, which show the widely varying pressures on countries' local water and wastewater markets. China and Singapore are singled out as countries looking to increasingly move westwards into markets such as the Middle East.

SembCorp exemplifies this push west. As the book relates, in July 2010 the company gained 92% of Cascal's equity (after a bitterly-fought campaign by Cascal to prevent Biwater selling its shareholding). This gives SembCorp a solid foothold in the municipal water and wastewater services market.

The yearbook explains the company's background of industrial water and wastewater service provision around the globe – in the UK, at the Wilton site on Teesside, a solid base of projects in China, and now a potential major tranche of work under the Cascal flag spread across Europe, Asia and the Americas. Cascal also of course held the operating licence for Bournemouth and West Hampshire Water, one of the UK's small south coast water-only companies.

BOOMING BRICS: Brazil, Russia, India and China

Brazil

The buoyant Brazilian market, by contrast, has predominantly become a local one characterised by the transfer of activities back from major players - notably Veolia, AWG and Earth Tech – over the past decade, the yearbook adds.

The yearbook notes that "contracting out to the private sector as opposed to commercialisation and the partial flotation of municipal concession holders remains at an early stage". In all, there are around 1350 water and sewerage entities in Brazil, of which 32 were operated by the private sector in 2005. By 2008 there were 40 private companies providing sanitation services to about seven million people in 63 Brazilian municipalities, excluding those companies that have been partially placed under private management through share issues, such as SABESP.

The country's public water and wastewater entities are facing serious problems – at least 11 of the 25 state-run waterworks companies are in what is classed as "serious financial distress" despite a significant injection of cash (BRL600 million) in 2008, the year under examination, for aid in financing projects, purchasing equipment and improving management.

A further $20 billion is required for the sector by 2017, according to estimates, and BRL110 billion out of a BRL178 billion total investment in the country to 2025 is required to provide universal sewage collection and treatment.

The Brazilian government is encouraging PPPs for smaller-scale water and wastewater projects through a Bill introduced in 2006. The yearbook also notes that "the three main private sector partnerships are more than holding their own in Brazil". Cop Asa has increased its water and wastewater concessions and Sanepar has renewed a number of contracts as well as agreeing a new 30-year concession in the Bom Jesus Do Sul municipality.

The private sector aims to cover 30% of the basic sanitation market in ten years, the yearbook notes. Some 26% of the country is served by outsourced water activities for water.

Russia

Because the focus this year is on the Americas and the East, Russia is covered only briefly, but interesting external players include Veolia Voda, which is 16.88% owned by the EBRD and active in the Russian Federation and Ukraine, central and Eastern Europe. Veolia's SPEP (Société Eau Pure, which is 51% GDE, 48% Vodokanal and 1% the St Petersburg municipality), has a five-year management contract for the city's 1.2 million m3 left bank water treatment works. Suez also has a million Russian Federation customers.

The major Russian players – the largest being Rosvodokanal, with over two million customers, RKS with 3.7 million customers, and Syzran Vodokanal with 186,000 customers - have not yet ventured into the international market. Their activities will be more fully covered in the next issue.

India

India is seen as a more promising territory for those looking for market opportunities, as the yearbook observes: "India is one of the most international of markets, with a wide variety of companies having been seen looking to gain contracts there. While United Utilities has sold off its activities, Manila Water has entered the market and Suez and Veolia Environnement have widened their activities through a range of pilot water management projects."

The country's ambition to have universal access to water by 1997, the 50th anniversary of independence, did not materialise and subsequent targets for water and wastewater coverage also seem to have slipped.

However, spending on the sector has increased, and this trend is set to continue. The yearbook notes: "Both the timings and the costs are likely to be on the optimistic side, with universal access to potable water unlikely before 2015 and sanitation taking another decade. The real cost for access to water is likely to be in the region of RS400-800billion and a further RS500- 1,000billion for sanitation and wastewater treatment."

For the private sector, this presents both opportunities and challenges. The yearbook explains that: "India's exceptionalist tradition means that the onus lies with foreign investors to argue the merits of their proposals in Indian terms. The National Rivers Conservation Directorate is willing to support BOT bids as part of its future policy."

A number of states are thought to be interested in wastewater treatment works BOTs, and the government has emphasised that it will encourage PPPs for water supply and sanitation expansions. Private sector involvement in contracted out operation and maintenance has been gaining in popularity, with Madras, Hyderabad and Ajmer taking this option.

International players include Va Tech Wabag in Chennai and Degrémont, with its ten-year Delhi wastewater treatment plant and Bangalore water treatment plant DBOs

China

This push from China and Singapore outwards will probably continue, Lane adds, "because we have a growing array of Chinese players who we still call regional/local but if you look at the numbers of people served, by any other standards they are very serious players and in any other situation they would be major players".

He says: "Given that we have one Chinese company involved in a project in the Middle East that is just starting to happen, if that goes well I think we will see more players in the Middle East. It is a very interesting development. I think it is also likely one or two players may want to hit the acquisition trail."

He predicts that China's influence will spread "over the coming months and years. Notwithstanding, it is a huge market for municipal and industrial wastewater treatment, desalination and drinking water. I think the biggest companies will go overseas."

In itself, China is still a market for international players involved in desalination, he adds, such as Veolia and Singapore's Hyflux. The yearbook explains that Hyflux Water Trust is a company set up by Hyflux specifically to manage its Chinese concession contracts – so far three water treatment works, eight wastewater treatment works and two water recycling plants, a portfolio of projects in 11 locations with a design capacity of 445,000m3/day.

"There are international players inbound into China, but we need to start taking real note of the march outward," adds Lane.

In terms of China's outwards push, so far Cheung Kong Infrastructure is spearheading the movement. The company, which is 85% held by Hutchinson Whampoa (the Hong-Kong based global retailer, telecoms and ports giant), owns Cambridge Water in the UK and (through AquaTower) provides water to four towns in the Australian state of Victoria.

The AMP 5 Challenge in the UK

There have also been some interesting developments outside these key countries. In the focus on the UK, the yearbook highlights an increasing focus on regulated activities at the expense of diversification. It identifies the AMP 5 final determination as the most testing for the water companies to date, warning that their response, "characteristically, has been to adopt a short-term perspective, while simultaneously turning on their suppliers to pare their margins to unsustainably low levels. Strategic supply chain management, as practised in the defence and automotive industries, for example, remains the exception for them even after all these years."

It adds: "In their partial defence, however, it has to be conceded that a five-year-span for a £22 billion plus spending programme is short-term and so the new government's decision to initiate a major review of economic regulation could be said to be timely. A government-imposed resolution, however, would be less flexible and efficient than an industry-inspired one and no substitute for strategic supply chain management."

Warnings were provided as the slide from listed into private equity continues: "While Ofwat maintains it is keen to have as many companies retaining a market listing, this carries little weight when the equity model can be materially less efficient that the debt one under the current regulatory settlement.

"This has been redoubled by Ofwat's proposals to introduce 'vertical competition' into the sector, although the momentum behind these proposals does appear to have eased during 2010. One of the key questions over the next few years will be how to encourage companies to return to the listed equity model, perhaps when the Private Equity players are seeking exits in a few years time."

Across the Pond

The headline issues of concern in the US are pinpointed as water quality – some 50% of the country's streams and an unknown percentage of groundwater are polluted to a significant degree, and the need to replace the country's ageing infrastructure.

The yearbook highlights the much-publicised American Society of Civil Engineers estimate of an annual shortfall of $11 billion for replacing or rehabilitating water and wastewater facilities, and its prediction that upgrading will cost between $550 billion to $1000 billion over the next 20 years. With limited government funding, the yearbook notes that the shortfall "has to be funded by municipalities, debt and innovative ways of delivering performance improvement".

The yearbook also lists some interesting positive and negative drivers for PSP, including on the positive side privatisations and IPOs, acquisitions (notably Aqua America and AWW in the US) and service extensions and population growth (exemplified by Manila Water).

Among the negatives, the report notes: "The USA can be a surprisingly hostile place for the private sector. Municipalities can 'condemn' a regulated operator under 'Eminent Domain' law and seek to buy its assets from the owner as recently seen at Pennichuck, a case that is already generating useful attorney fees."

Time (in the sense of time-limited contracts), divestments as companies change strategy or back out of unworkable contracts, and population decrease, which will affect Europe, are also identified as negative drivers.

In terms of the future for PSP, urbanisation, and the strains this places on infrastructure, are seen as naturally offering scope for "the more widespread adoption of private finance in the provision of water and sanitation services, in the process by-passing administrative and political bottlenecks, enhancing transparency in public administration and combating corruption".

Eastern Promise

Summing up, the report brings into focus the past year's events in the sector, as Lane concludes: "It pulls together things you half see through the course of the year – it is more sharp, and gives order and perspective."

It also, of course, gives interesting focus to the shape of things to come, which, from the trends identified, looks full of eastern promise. As the yearbook notes: "In previous editions, the rise of China has been noted. It is evident that the BRIC (Brazil, Russia, India and China) acronym has an increasing global resonance as well. In particular, India and Russia are now developing at a rate which may not have been foreseen a few years ago."

Next year's report is likely to see further proof of this trend, with more evidence of China in particular pushing out to the Middle East and beyond.

More Water & WasteWater International Current Issue Articles

More Water & WasteWater International Archives Issue Articles