Desalination and wastewater treatment top investment forecast for global water market

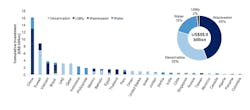

The market for water public-private partnership (PPP) projects is set to nearly triple between 2016 and 2020.

New market activity will add an average 6 million m3/day of treatment capacity annually versus approximately 6 million m3/day between 2010-2015, according to a new report.

Bluefield Research said its findings show total investment is expected to surpass US$58 billion, of which 80% will target new seawater desalination and wastewater treatment plants.

Dramatic declines in oil and commodity prices, low water tariffs, groundwater overdrafts, and untreated wastewater discharges are prompting governments to tap the private sector, the company said.

The global adoption of the water PPP model will come to the fore in the next five years through a combination of continued growth in markets where the model is well-established (China, Brazil), resurgence in markets that have stalled (Indonesia, Philippines, Mexico, Egypt), and new markets opening up (Persian Gulf countries, Vietnam, Peru, the United States).

"Particularly in emerging markets, led by China, municipalities are hard pressed to match the financial capacity and operational expertise that the private sector can provide," said Phuong Pham, senior analyst at Bluefield Research. "National governments aim to de-risk their water sectors for private investment with new PPP laws and more attractive contract tenders, while preserving long-term control over assets."

Above: Water PPP Projects Planned by Country and Asset Type, 2016-2020

An increasingly diverse group of private and semi-private firms are responding to new tender opportunities for PPP contracts.

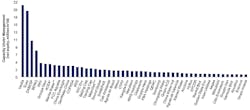

Bluefield said its analysis of the portfolio strategies of the 50 largest global water players indicates that the water PPP market is in transition, with a cast of new players emerging.

The global PPP market is led by integrated water players Veolia and Suez who have sustained their positions in recent years with over 19 million m3/day of capacity each, followed by semi-private local utilities (SABESP, COPASA), rapidly scaling Chinese players (BEWG, China Everbright), emerging utility concessionaires (Manila Water, AEGEA) and integrated water players (Aqualia).

"Many players turned their backs on PPP opportunities during the recent recession because of their capital intensity, while they deleveraged and reviewed their value chain positions overall," said Keith Hays, vice president of Bluefield Research. "This market shakeout has left a field of players with clearer strategies to navigate continued macroeconomic uncertainty and address new opportunities."

Above: Top 50 Global PPP Players, Capacity Under Management 2015

The full report is entitled Public-Private Partnerships in Water: Company Strategies & Market Opportunities, 2016-2020, based on an analysis of over 1,800 PPP projects in 44 countries. For more information click here.

###

Read more

Philippines’ water market ripe for European participation, finds new report