As we enter a new year, shifting market forces will continue to reshape strategies for companies across the water value chain, from technology vendors to utility and corporate stakeholders. In many respects, the cause for change has been underway for decades, but the unexpected has compounded the list of challenges.

A disrupted workforce, tight supply chain and an ironically predictable volatile climate (e.g., drought, wildfires, large storms), is changing the rules of the game. Cities and companies are being forced to rethink the traditional solutions that worked last century, let alone last decade.

The water industry was already headed this way, but the COVID-19 pandemic has placed even more emphasis on digital water solutions, while also demonstrating how far the industry has come in terms of digital transformation. Utilities are adopting digital technologies at a faster rate than before and 2022 will be no different — digital will continue to play a key role in all facets of the water industry.

Read on for a few of the top trends to watch across the municipal water market in 2022.

A Changing Workforce Presents New Opportunity

There are now almost 950 digital water vendors pitching solutions to municipal and industrial firms. One lesson learned from this pandemic period is that the organizations further along on the adoption curve for solutions like remote network monitoring or IoT technology were better prepared to react to the sudden changes in the workplace.

Not only are more water network and system operators working remotely but organizational risk to “the Great Resignation” is greater than ever. After all, labor represents more than 40 percent of total operating expenditures for water and wastewater systems. From 2016 to 2026, the Bureau of Labor Statistics (BLS) projects that 10.6 percent of water sector workers will leave (i.e., retire or transfer) their jobs, annually.

This creates opportunities for technology promoters, engineering and services firms and product integrators to close the knowledge gap. The result will be an increasing reliance on digital solutions to enable and insulate utilities’ and companies’ intellectual capital. Companies such as Trimble, Mueller or Xylem, which are actively building platform positions in the remote monitoring and IoT space, will benefit. We also expect to see more players — water industry insiders and outsiders — seek ways to strengthen their portfolios.

Big Tech Sees Water as Strategic Priority

The pivot toward digital is everywhere, from Zoom to Netflix to Bitcoin, and is driving up the number of thirsty hyperscale data centers. At the same time, the projected water usage is expected to reach 221 million gallons per day to cool these massive server rooms. For this reason, water is on the corporate brain and tech firms like Microsoft, Google, and Facebook are committing to being “water positive” over the next decade.

By focusing on greater water efficiency, solutions like on site reuse, rainwater capture and dry cooling are increasingly on the table, particularly as local authorities from Berkeley County, S.C., to Mesa, Ariz., push back on groundwater withdrawals by industry. Simply put, in some cases, the answer might be as easy as raising the temperatures of server rooms.

More Deals from Strategic and Financial Investors

On track to have the most deals ever recorded in the water industry, through the first half of 2021, Bluefield reported the highest six-month deal flow to date with 239 deals, which included several billion-dollar deals. The private water and digital water segments contributed the lion’s share of transactions, while the midstream, diversified, and network and distribution segments saw the greatest growth in deal flow relative to the first half of 2020. Strengthened by infrastructure stimulus, technology adoption and ESG, the tailwinds for investment are strong.

Supply Chain Impact on Water Market Strategies

Supply chain challenges for utilities are expected to continue working through the water sector during much of 2022. More than 30 percent price increases in key inputs like iron, steel and PVC, let alone labor, will further hamstring or delay projects that are already on the margins, with implications for metering companies, pipe companies, and utilities. As a result, public water technology and equipment manufacturers will be forced to increase material costs to their customers, raising prices in line with input costs.

In November 2021, the House passed a $1 trillion bipartisan infrastructure bill, which outlines $55 billion for drinking water, wastewater and stormwater infrastructure. What remains to be seen is how much of this funding will filter into the digital water space and how much will reach the market’s traditional network and treatment infrastructure. Notable appropriations of funds for lead service line remediation and cybersecurity showcase a national realization of long-deferred water quality problems — as well as several emerging challenges related to the Internet of Things.

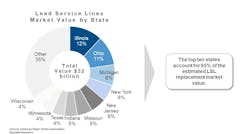

Many cities and municipalities are feeling a renewed sense of urgency around lead service lines (LSL). Bluefield estimates some 6.1 million LSLs remain in the ground across the United States, serving between 15 million and 22 million people. Analysis shows that full replacement will require over $32 billion, driven by 10 states that account for approximately 65 percent of the replacement market value.

As anticipated, the well-established State Revolving Fund (SRF) programs — one for drinking water (DWSRF), one for wastewater (CWSRF) — will serve as critical channels to market. Since 2000, these critical sources of capital via loans and grants make up an average of 14.4 percent, or $7.7 billion, of annual capital expenditures in the U.S. — but this will give the SRF programs a significant boost to funding for critical areas such as pipe networks, advanced treatment systems, water reuse, and PFAS. To put it in perspective, the 2020/2021 fiscal year resulted in loan and grant requests for 12,012 projects totaling $93.8 billion, of which $71.6 billion went unfunded.

Convergence of Critical Infrastructure Highlighting The Water-Energy Nexus

The convergence between water and other critical infrastructure service providers (e.g., gas, electric power) is showing signs of activity. Headlined by large water platform acquisitions, electric/gas companies and independent power/gas providers are looking to water and wastewater assets beyond their core business footprints.

By leveraging in-depth understanding of infrastructure investment, customer rate-bases, utility workforce management, and utility commissions, outsiders looking into the water market foresee operational and financial synergies. NextEra’s entry into the regulated water utility sector marks the fifth electric and gas services provider in recent years to build water positions under their banner.

Climate-Driven Events Put Focus on Reuse, Resilience, Corporate Sustainability

There has no doubt been a growing frequency of global climate events, many unexpected. The U.S. alone has sustained 255 weather and climate disasters exceeding $1 billion since 1980 — not including the lower profile, more pedestrian events like boil advisories, water main breaks, and contamination; all of which can have crippling effects on municipalities. While potable water supplies gain more attention in the water-stressed region of the western U.S., interest in water reuse is also growing in the eastern U.S.

Deploying alternative approaches, solutions, and more efficient water management strategies that enable society to live with unexpected climate events will take on greater priority. There are already more than 700 municipal water reuse systems in the U.S. and a handful of desalination plants in various stages of planning that will increasingly become necessary, irrespective of cost, to mitigate water supply risks for cities. At the same time, rising investments in more innovative irrigation and farming practices, which are on the rise, are poised to scale.

Where Do We Go from Here?

As we enter 2022 and vaccination rates climb, there are still a lot of unknowns: How will municipal budgets be impacted? Can we expect more water quality regulations? How will the focus on corporate sustainability and ESG impact the municipal water sector?

What will undoubtedly prove true is that the water sector will see change, and that company strategies will adapt in parallel. WW

Published in WaterWorld magazine, December 2021.