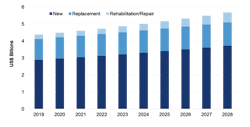

BOSTON, MA, NOV 21, 2019 -- More than US$234 billion of capital expenditures (CAPEX) are forecasted over the next decade to address aging municipal water & wastewater pipe network infrastructure. Precipitated by decades of underinvestment, municipal utilities are under increasing pressure to address deteriorating linear assets at a faster pace.

According to Bluefield Research’s new report, Underground Infrastructure: U.S. Water & Wastewater Pipe Network Forecast, 2019-2028, pipe networks and associated hardware (e.g. manholes, hydrants, valves) make up 37% of total forecasted municipal CAPEX that includes water & wastewater treatment facilities.

“The cost of managing 3.2 million miles of underground distribution and collection systems is escalating for municipalities”, says Erin Bonney Casey, Research Director for Bluefield. “Stakeholders from utilities to customers have benefitted historically from this incredible array of pipes and hardware, but, unfortunately, the bill is coming due to rehabilitate existing assets, let alone build new ones to meet growing population demand.”

Water losses through leaks for U.S. utilities average 15% annually, with some cities, towns, and communities losing more than half of all water pumped and treated for distribution to customers. As a result, rehabilitation of existing pipes is the fastest growing spend category, increasing annually from US$253 million in 2019 to US$576 million by 2028. Network expansions, particularly in high population growth across the sunbelt states (e.g. Texas, Arizona), will drive the lion’s share of spend on new build.

At the same time, rising costs to address these growing needs will continue reshaping the installed material types. Well-established, large urban centers (e.g. Boston, New York) will continue to rely on traditional, legacy materials, like ductile iron, while suppliers of polymer-based pipes (e.g. PVC, HDPE) will make greater inroads on the peripheries of existing pipe networks, where developers have greater influence on procurement.

“The scale of investment required necessitates prioritizing rehabilitation of these aging assets and is expected to usher in more advanced asset management, such as predictive analytics,” says Ms. Bonney Casey. “And in some cases, as we are already seeing in select cities, the opportunities for private investment, or investor-owned utilities, will increase because of these escalating costs. Irrespective of the solution, utilities are increasingly forced to do more with less—and the pipe network is no exception.”

Learn more at www.bluefieldresearch.com.